Quick Summary

Factoring rates are not fixed. They are driven by risk, predictability, and how much effort it takes to manage your receivables.

Full ledger factoring often lowers factoring costs because it spreads risk across all invoices, improves payment predictability, and reduces administrative work. In some cases, it can even cost the same as selective factoring while providing more cash availability and flexibility.

Most business owners believe factoring rates are fixed. You request a quote, receive a number, and assume that it is final.

This is a common misconception.

Factoring is not priced like a loan. Rates depend on risk, predictability, and required effort. This is why full ledger factoring, in comparison to selective factoring, often leads to lower costs, despite appearing to be a larger commitment.

Here is how it works.

Factoring Rates Are Not Random. Here’s What Determines Pricing

- How many invoices do you issue on average?

- How often do customers pay?

- How spread out are your receivables?

- How much manual work is required to manage your account?

Why Invoice Volume Matters More Than Most People Think

Factoring only one or two invoices at a time increases risk. If a customer disputes, short-pays, or fails to pay an invoice, there is no additional cash flow to offset the loss. This concentration of risk leads factoring companies to charge higher rates.

Now compare that to a business factoring its entire ledger.

With full ledger factoring, the factor sees consistent payment flows from multiple customers. While payment timing varies, overall patterns remain stable, increasing predictability and reducing risk.

This stability is valuable. It often results in lower discount fees because there is less uncertainty to price in.

In summary, full ledger factoring reduces portfolio risk.

Diversification Lowers Your Costs

An important but often overlooked factor in pricing is customer concentration.

If one customer represents a large share of your receivables, risk increases. Distributing receivables among many customers reduces risk, which affects advance rates, reserves, and fees.

Full ledger factoring naturally improves diversification because all invoices are included. Cherry-picking invoices removes that benefit.

Many companies that use spot or selective factoring may not realize they are paying a concentration premium. While it may not be explicitly stated on the term sheet, it is reflected in advance rates, reserves, and overall pricing structure.

Operational Costs Also Influence Your Factoring Rate

Factoring companies price both risk and effort. Spot factoring & selective factoring require more administrative work, which increases costs.

Each invoice requires separate review, repeated document checks, and unpredictable funding schedules, all of which increase manual effort.

Full ledger factoring is easier to manage, with a consistent invoice flow, greater automation, and risk review at the account level rather than per invoice.

Accounts requiring less manual oversight are cheaper to service. This often results in lower rates or better advance terms.

Why Are Advance Rates Often Higher With Full Ledger Factoring

Greater predictability usually leads to higher advance rates.

When factoring companies have a complete view of your receivables, they are more comfortable advancing a larger percentage of each invoice, giving you greater access to cash.

Even a small increase in advance rate can significantly improve daily cash flow and reduce funds held in reserve.

Over time, this accelerates cash flow back into your business. This timing is often more important than it appears when evaluating true cost.

When Lower Risk Can Create More Flexibility at the Same Cost

Two factoring structures can produce very different results, even when costs are similar.

When a business only needs to factor a few invoices, selective factoring is often preferred because it’s simple and addresses a specific cash need.

But a full ledger agreement, because of typical lower rates and higher advances, can sometimes offer greater flexibility at a similar cost: more cash upfront, with additional funds available if needs change.

Here’s an example

Let’s say that a business invoices $200,000 per month and needs $120,000 in working capital.

Selective factoring

- Invoices sold: $150,000

- Advance rate: 80%

- Cash received: $120,000

- Discount fee: 3.00%

- Total factoring fee: $4,500

Full ledger factoring

- Invoices sold: $200,000 (entire ledger)

- Advance rate: 90%

- Cash advanced upfront: $180,000

- Discount fee: 2.25%

- Total factoring fee: $4,500

- Unused funds remain available and do not need to be drawn.

In this example, the total cost is the same for both structures. However, full ledger factoring gives you more cash right away. You may pay roughly the same fees while having much more freedom.

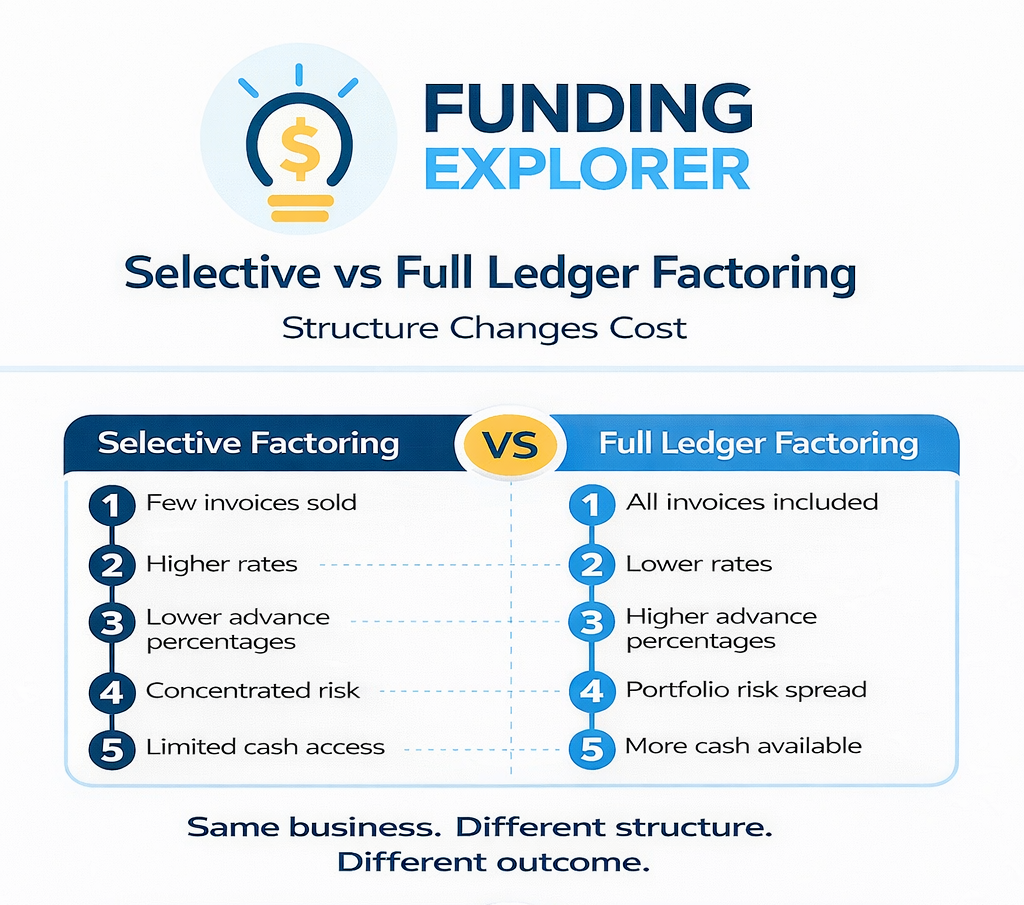

Selective Factoring Vs. Full Ledger Factoring Comparison Chart

| Feature | Selective Factoring | Full Ledger Factoring |

|---|---|---|

| Invoices sold | Only selected invoices | All invoices in the ledger |

| Typical use case | Occasional or targeted cash needs | Ongoing working capital support |

| Risk profile | Concentrated on a few invoices | Spread across the full receivables portfolio |

| Pricing impact | Often higher rates due to concentration | Often lower rates due to diversification |

| Advance rates | Usually lower | Often higher |

| Cash availability | Limited to invoices sold | Higher availability, even if not all cash is used |

| Operational effort | Invoice-by-invoice review | Account-level review and automation |

| Flexibility | More cash requires factoring additional invoices | Additional cash is available if needs change |

| Best fit for | Short-term or infrequent needs | Businesses seeking flexibility and stability |

When Full Ledger Factoring is Not The Right Move

Full ledger factoring is not suitable for every business situation.

If you only need cash occasionally, selective factoring is often a better option. It addresses your cash flow needs without having to factor all your receivables.

Seasonality is also a factor. Businesses with uneven revenue cycles may prefer getting funding only during peak periods rather than committing to a full ledger structure year-round.

Also, if most receivables come from one or two customers, full ledger factoring may not significantly reduce risk or improve terms.

How Businesses Qualify For Lower Factoring Costs

- Clean invoicing

- Consistent billing cycles

- Multiple customers with no heavy concentration

- Willingness to be transparent with their receivables

Conclusion

Factoring should not be considered solely an invoice-level decision.

It is a strategic portfolio decision.

Giving your funding partner full visibility into your receivables reduces uncertainty. As uncertainty decreases, pricing improves, advance rates increase, and cash flow becomes more consistent.

If you are using selective factoring or find your pricing higher than expected, the issue may be the structure rather than the rate.

At Funding Explorer, we help business owners review their full receivables and determine whether a different factoring structure could reduce costs and improve cash flow. A full ledger review often reveals new options.

If you want clarity rather than a sales pitch, we are happy to discuss your options.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: January 23rd, 2026

Business Funding Expert Insights

Want to know if full ledger factoring actually makes sense for your business?

At Funding Explorer, we help business owners review their receivables, compare selective and full ledger options, and understand how different structures affect real cost and cash access.