What Is a Factoring Broker? How Working With One Can Save You Time, Money, and Stress

If you’re looking into invoice factoring, you might be asking yourself:

“Should I apply directly to factoring companies, or should I work with a factoring broker?”

Many business owners aren’t sure what a factoring broker does or how the right broker can help you get approved faster, avoid mistakes, and get better terms at no extra cost.

This guide will cover:

- What a factoring broker is

- What do they do

- Why is the service completely free for you

- Why your fees don’t go up when you use a broker

- How brokers can save you time, stress, and often thousands of dollars

What Exactly Is a Factoring Broker?

A factoring broker is a business funding expert who helps match your company with the factoring company that best fits your industry, customers, invoice cycle, and funding needs.

Put simply, a broker acts as a matchmaker between your business and the right factoring partner.

A good broker knows:

- Which factoring companies fund which industries

- What types of customers does each factor accept

- Their advance rates, pricing, and terms

- Their underwriting rules

- Their speed and service quality

- How open they are to start-ups, credit issues, or customer concentration

This helps you avoid applying to the wrong companies and getting turned down repeatedly.

Why Most Businesses Are Better Off Using a Factoring Broker

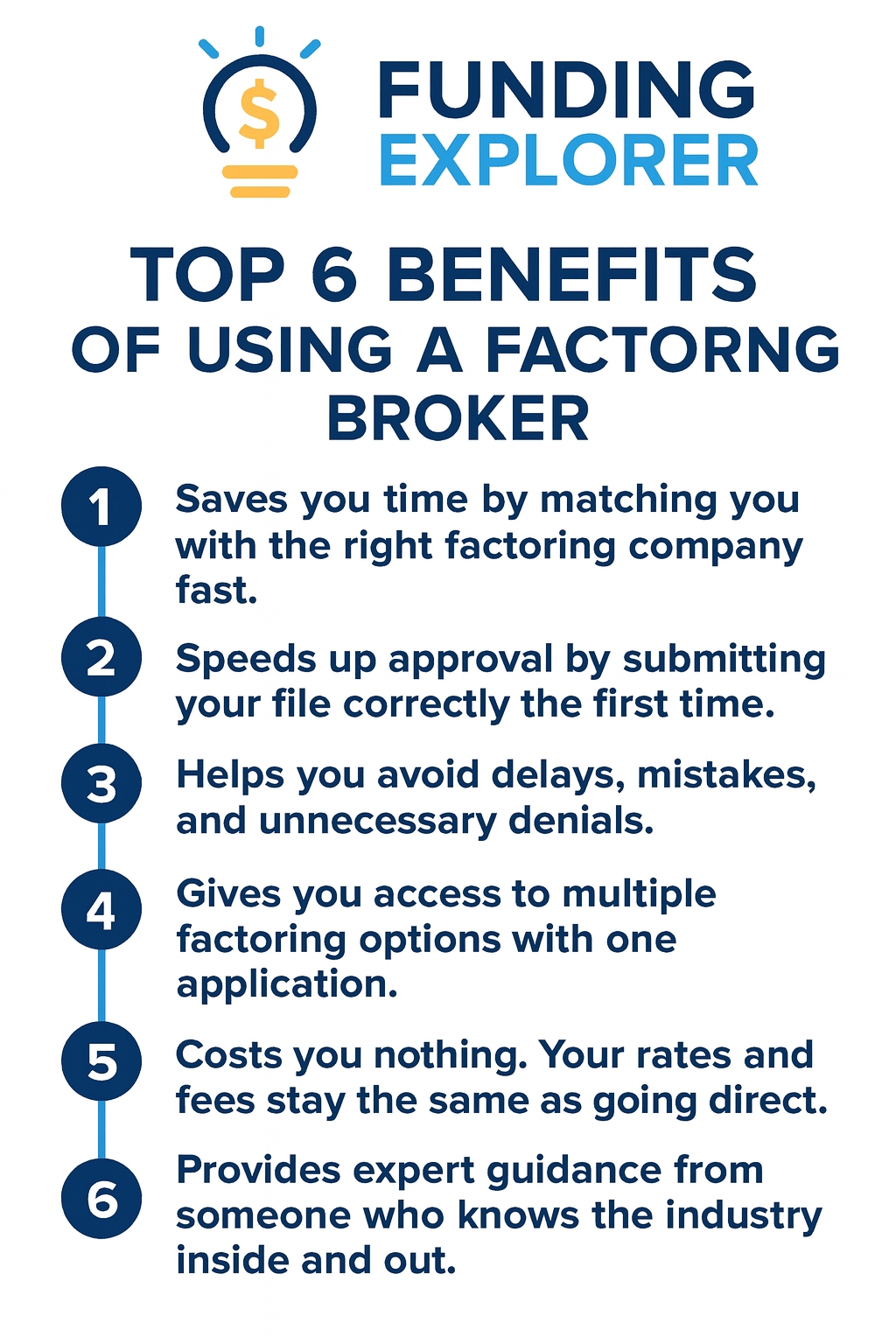

Here are the main benefits:

A Broker Knows Which Companies Are Likely to Approve You

Every factoring company is different. Some focus on:

- Trucking

- Staffing

- Manufacturing

- Government contracts

- Construction-related trades

- Medical receivables

- Others avoid those industries altogether.

A broker already knows which companies:

- Work with your industry.

- Accept your type of customers.

- Can move quickly when you need to make payroll.

- Offer fair terms and transparent pricing.

- Handle small businesses or start-ups.

- Can work with UCC filings or lien issues

This saves you days of trial and error and helps you avoid unnecessary denials.

A Broker Helps You Get Approved Faster

When cash flow is tight, especially before payroll, every hour counts.

A broker helps you:

- Submit the correct documents the first time.

- Avoid delays caused by missing or incorrect paperwork.

- Put together a complete and accurate underwriting package.

- Make sure your file gets to the right decision-maker

- Avoid companies that are slow or require lots of back-and-forth.

This can often speed up approval by one to three days.

Simplify the entire approval process. Get expert help in minutes.

You Don’t Have to Apply to Multiple Companies

If you apply directly, you may:

- Get denied

- Waste time

- Restart the entire process with another factor.

- With a broker, you fill out one application, and they quickly match you with the best partner.

This saves you hours of work.

A Broker Helps You Avoid Choosing the Wrong Factoring Company

Choosing the wrong factor can lead to:

- Slow funding

- Long verification times

- Unclear communication

- Poor customer service

- Unexpected fees

- Frustrated customers

A broker’s job is to help you avoid these problems by guiding you to a factor that is fast, fair, transparent, easy to work with, and a good fit for your industry.

Want to avoid delays? Let a Funding Explorer match you with the right factor the first time.

Why Factoring Broker Services Are Completely Free for You

Here’s something that surprises most business owners:A factoring broker doesn’t cost you anything. You never pay the broker.

That’s because factoring companies pay brokers, not clients.

But does that mean your rates go up?

No, it doesn’t. Your fees stay the same whether you go directly to a factoring company or use a broker.

Here’s why:

Factoring companies spend enormous budgets on ads, SEO, marketing, and sales.

Google Ads alone can cost them hundreds of dollars per click in competitive industries.

Paying a broker a commission is often less expensive than advertising.

So to repeat:

- Your rate doesn’t go up because you used a broker.

- Your fee doesn’t increase.

- Your contract stays the same.

Get answers promptly, avoid mistakes, and move forward with confidence. All at no cost to you.

Benefits of Using a Factoring Broker vs. Contacting Factoring Companies Individually

| Feature / Benefit | Using a Broker | Going Direct |

|---|---|---|

| Number of Applications | One application for multiple options | Apply separately to each factor |

| Approval Speed | Faster, broker knows who will approve you | Slower, trial and error |

| Match Quality | High, broker finds the right fit | Hit or miss, may choose wrong company |

| Cost | Free, broker is paid by factoring company | Free, but no added guidance |

| Do Fees Increase? | No, same rates as going direct | No, but you get no expert review |

| Industry Fit | Broker knows which companies fit your profile | You must guess which factors accept your industry |

| UCC / Lien Issues | Broker guides you to companies who can work around them | You discover issues after applying |

| Document Preparation | Broker ensures a clean, complete package | You're on your own |

| Risk of Delays | Low, broker prevents common mistakes | High, missing info or wrong factor |

| Access to Options | Many options instantly | Must search and compare yourself |

| Stress Level | Low, guided expert help | High, lots of uncertainty |

| Ideal For | Businesses wanting fast, accurate approvals | Businesses who already know the right factor |

If you want the fastest approval with the right factor, we’re here to help.

About Funding Explorer

Funding Explorer was started to make the factoring process simple, fast, and transparent.

With more than ten years of experience working inside factoring companies, we know:

- How underwriters think

- Which industries does each factor prefer

- What causes delays

- How to match businesses with the best partner

- How to avoid bad contracts and hidden fees

Our service is free, fast, and simple, and we focus on matching you with the right factoring company the first time.

We’re here to help you get funding without confusion, stress, or wasted time.

If you want the fastest approval with the right factor, we’re here to help.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: December 18th, 2025

Invoice Factoring Expert Insights

Get Expert Guidance at No Cost

Cut through the noise and skip the confusion. Our experts, with over 20 years of experience in business finance, will match you with the factoring program that truly fits.