Quick Summary

Factoring cost is more than just the rate. What businesses actually pay depends on how fees are calculated, how much cash is advanced, how risk affects advance rates, and how much invoice volume must be factored to meet cash needs.

Even with the same rate, lower advances and different fee structures can lead to higher real costs over time. This article explains how fees, advances, risk, and structure interact, helping businesses compare factoring options accurately and avoid paying more than necessary.

Most business owners believe factoring cost is defined by a single number: the rate.

You receive a quote, see a percentage, and assume that tells you how expensive the financing will be. But many businesses later discover that their actual costs don’t match what they expected. Two companies with similar rates can end up paying very different amounts over time.

That disconnect exists because factoring doesn’t work like a loan. The rate is only one part of a larger system. What you really pay depends on how fees are calculated, how much cash you actually receive, how risk affects advances, and how the structure of the agreement fits your business.

To understand what factoring really costs, you have to look at how all of these pieces interact.

The Most Common Mistake: Comparing Factoring to a Loan

When businesses compare factoring offers, they usually compare percentages.

2.25% versus 2.75%.

3.00% versus 3.25%.

It feels logical to assume the lower rate is cheaper. But factoring isn’t priced on borrowed cash. It’s priced on receivables’ face value and sometimes on advances, which changes how costs show up in practice.

Two companies can receive the same quoted rate and still experience very different outcomes. In many cases, the business with the lower rate ends up paying more over the year.

To see why, you first need to understand what factoring fees are actually charged on.

What Factoring Fees Are Charged On (And Why This Varies)

Factoring fees are not calculated the same way in every agreement.

In many traditional factoring structures, fees are charged on the full invoice amount, regardless of the advance. In other structures, often selective or short-term arrangements, fees may be charged on the amount advanced instead.

Both models exist. Neither is inherently better.

What matters is understanding which base your fee is applied to, because that determines how advances, volume, and funding frequency affect your real cost.

This variation is one of the main reasons comparing factoring offers can be confusing.

Why Advance Rates Still Matter, No Matter How Fees Are Charged

Even though fees can be charged on different bases, advance rates still play a critical role in determining real cost.

The advance controls how much usable cash you receive for the fee you’re paying. When advances are lower, more of your money is held back in reserve. When advances are higher, more cash is available immediately.

Let’s look at a simple comparison.

Invoice: $100,000

Rate: 2.25%

Fee Charged on Invoice Amount

- Fee: $2,250

- 80% advance → $80,000 cash

- 90% advance → $90,000 cash

Same fee. Different funding outcome. Different Effective Cost.

| Advance | Fee |

Cash Received |

Effective Cost on Cash |

|---|---|---|---|

| 80% | $2,250 | $80,000 | 2.81% |

| 90% | $2,250 | $90,000 | 2.50% |

Fee Charged on Amount Advanced

- 80% advance → fee on $80,000 = $1,800

- 90% advance → fee on $90,000 = $2,025

The fee base changes, but the core issue remains: lower advances mean less usable cash per transaction.

In both models, advance rates directly influence how much funding you receive and how much volume you need to factor to meet your cash needs.

How Advances Change the Real Cost, Even at the Same Rate

When advances are lower, businesses often need to:

- factor more invoices, or

- factor larger volumes, or

- factor more frequently

All of these increase total fees over time, even when the rate stays the same.

For example, if a business needs $90,000 in cash each month:

- At an 80% advance, it must factor $112,500

- At a 90% advance, it only needs to factor $100,000

Same cash needed. Same rate. Different factoring volume.

Over a year, that difference alone can translate into thousands of dollars in additional fees, regardless of whether fees are charged on invoices or advances.

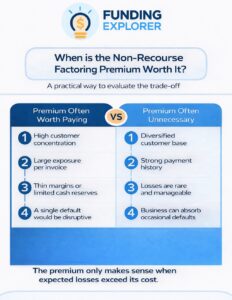

Why Advance Rates Differ: Risk and Dilution

Advance rates are not arbitrary. They are driven by perceived risk.

Anything that makes collections less predictable reduces advances, including:

- customer concentration

- invoice disputes or credits

- short payments

- inconsistent billing

- spot or one-off factoring

This is often referred to as dilution, the gap between what is invoiced and what is ultimately collected.

Higher dilution risk means:

- lower advances

- more cash held in reserve

- less usable cash upfront

Lower dilution risk supports:

- higher advances

- less reserve

- better access to your own cash

Risk doesn’t just affect pricing. It affects how much funding you can actually use.

The Hidden Impact of “Small” Extra Fees

In addition to the main factoring fee, many agreements include ancillary charges such as:

- wire or ACH fees per funding

- transaction or processing fees

- monthly minimums

- lockbox or account maintenance fees

Individually, these fees look minor. But their impact depends on how often you fund and how much cash you receive each time.

When advances are lower or funding is more frequent, these small fees consume a larger percentage of usable cash. Over time, they materially increase the real cost of financing.

This is why businesses factoring smaller amounts more frequently often feel that costs add up faster than expected, even when rates appear competitive.

Why Structure Multiplies or Reduces Cost

Factoring structure ties everything together.

- Spot factoring concentrates risk, often leading to lower advances and higher effective costs.

- Selective factoring allows businesses to match funding to actual needs, controlling volume and fees.

- Full ledger factoring can reduce risk and improve advances but increases the total volume factored.

None of these structures is inherently good or bad. The cost outcome depends on how well the structure aligns with your cash flow patterns.

Factoring more invoices than necessary, even at a lower rate, often increases total cost without creating additional value.

Why a Higher Rate Can Sometimes Be Cheaper

This is one of the most counterintuitive aspects of factoring.

A higher rate combined with a higher advance can result in:

- less volume factored

- fewer funding transactions

- lower total annual fees

Meanwhile, a lower rate paired with a lower advance can force a business to factor more just to reach the same cash target. This is why comparing rates without understanding advances and fee bases often leads to the wrong decision.

How to Think About Your Real Factoring Cost

Instead of asking, “What’s the rate?” a better set of questions is:

- On what amount is the fee charged?

- How much cash do I actually need each month?

- What advance will I receive?

- How much invoice volume must I factor to reach that cash amount?

- How often will I fund, and what extra fees apply?

Those answers determine real cost far more than the advertised percentage.

How We Help Businesses Understand Factoring Cost Before They Commit

At Funding Explorer, we help business owners look beyond the rate.

We analyze:

- cash flow needs

- advance scenarios

- risk and dilution

- fee structures

- factoring volume and frequency

- total annual cost

The goal isn’t to push more factoring. It’s to make sure the financing you use matches how your business actually operates, without quietly costing more than it should.

Final Thought

Factoring cost is not just a percentage.

It’s the interaction between fee structure, advances, risk, and usable cash. When you understand that interaction, factoring becomes a strategic tool instead of a confusing expense.

If you’re evaluating factoring options, clarity on these mechanics can make the difference between a smart funding decision and an expensive surprise.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: February 3rd, 2026

Business Funding Expert Insights

Don’t compare factoring offers by rate alone

We help business owners understand how advances, risk, and structure affect real cost, before they sign anything.