- Selective factoring lets businesses decide how many invoices to factor and when, rather than factoring every invoice throughout the year.

- Seasonal businesses usually see sales go up and down, while their expenses stay about the same. This can lead to regular cash shortfalls.

- Factoring all your invoices every month can end up costing more overall, even if the rates are lower.

- Selective factoring can save you money each year, even with higher rates, because you only pay fees on the invoices you choose to factor.

Businesses like manufacturers and distributors often face cash flow issues at certain times of the year. Their main challenge is not making a profit but timing when money arrives.

Sales rise and fall throughout the year, but expenses usually stay the same. When revenue falls or customers take longer to pay, cash flow can become tight. But when revenue increases, cash flow is plenty.

Because of this, if you see factoring as an all-or-nothing option, you could end up paying for financing you don’t always need.

In these situations, a selective agreement can help you control your financing costs.

What Is Selective Factoring?

With selective factoring, a business can choose which invoices to factor and when, rather than factoring every invoice each month.

This type of factoring lets a business adjust how much it uses based on its cash needs. When cash flow is strong, there’s no need to factor every invoice.

Selective factoring often comes with higher rates than full ledger factoring. However, if your cash needs are limited or predictable, your total yearly cost can be lower because you only pay fees on the invoices you factor.

Why Seasonal Businesses Might Not Need to Factor All Their Invoices All Year

Most seasonal businesses don’t need extra working capital every month.

Factoring all invoices helps when cash needs are high or unpredictable. If needs are steady and predictable, factor all your financing costs without offering any benefit in exchange.

The best strategy should be focused on figuring out how many invoices to factor each month to have enough cash to operate while minimizing your costs.

Case Study: A distributor that uses selective factoring to fulfill predictable cash needs

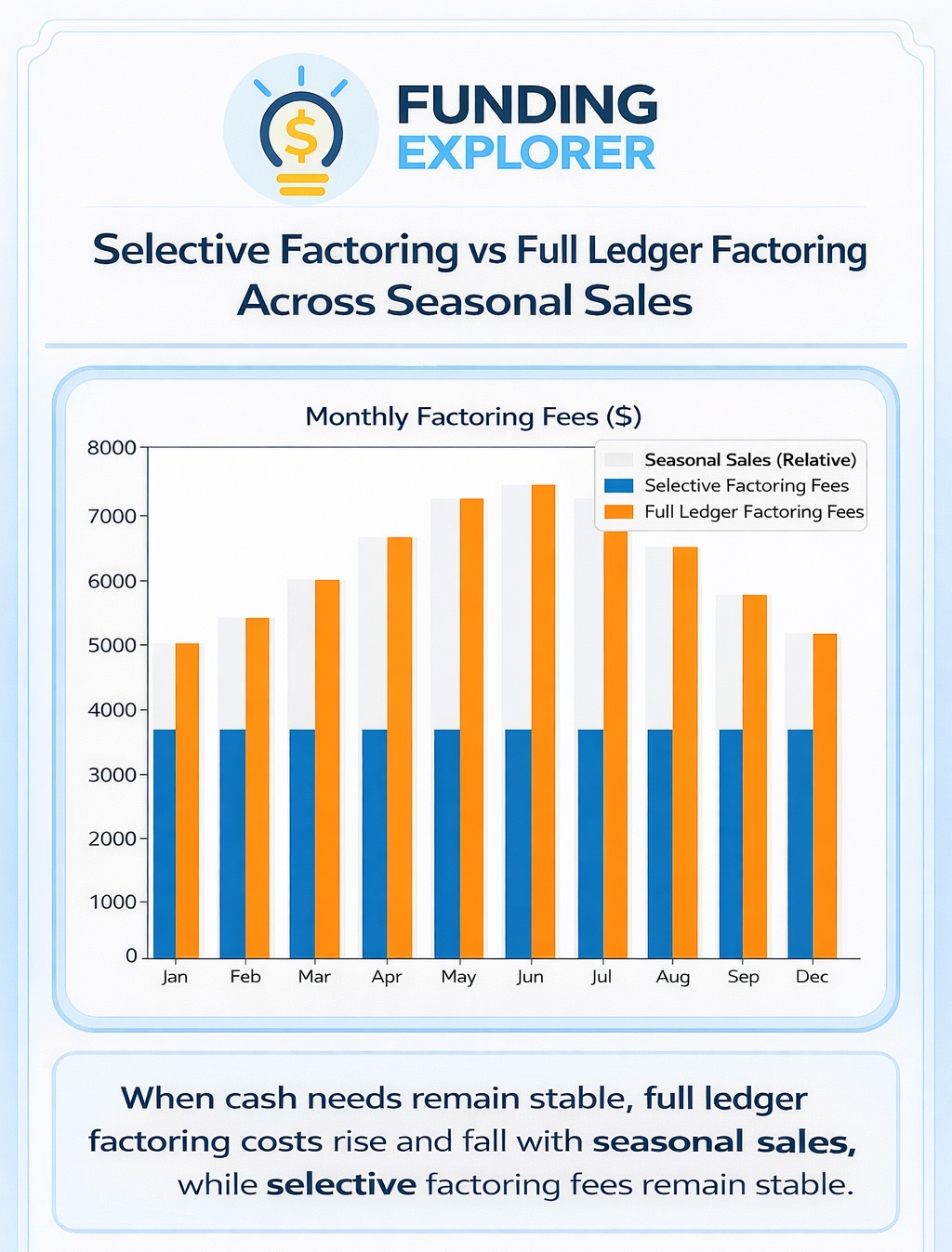

Let’s look into the situation of this distributor, which operates year-round and invoices customers every month. Its sales fluctuate with the seasons.

Sales each month are between $210,000 and $360,000. Due to this fluctuation, income goes down in the winter and late in the year but then increases in the summer. Costs like rent, salaries, and other operational costs stay essentially the same all year.

The business still needs the same amount of cash each month to pay for fixed or semi-variable costs, even as sales go up and down. The idea isn’t to get as much funding as possible, but to have a steady amount of cash on hand to cover the time between invoicing and getting paid.

Option one: Using Selective Factoring

With this funding strategy, the distributor doesn’t factor all of its invoices when sales go up. Instead, it uses selective factoring to keep a stable $100,000 in working capital each month.

This $100,000 is enough to cover payroll, operational costs, and other cash flow gaps due to slow customer payments.

Structure of selective factoring:

- Invoices factored each month: $100,000

- Discount rate: 3.25%

- Monthly factoring cost: $3,250

- Annual factoring cost: $39,000

This approach keeps the business’s cash flow stable and its financing expenses under control all year long.

Option Two: Full Ledger Factoring

With full ledger factoring, the distributor factors every invoice every month, no matter how much cash they need.

Together with the changes in sales, the factored amount and factoring costs change monthly.

This is the full ledger structure:

- Invoices factored monthly: $210,000 to $360,000

- Discount rate: 2.25%

- Monthly factoring cost range: $4,725 to $8,100

- Annual factoring cost: $75,150

As you can observe, this factoring arrangement provides more funding at a lower rate, but because the business does not need that much cash, they end up paying extra fees for money that sits unused in their bank accounts.

Selective Factoring vs. Full Ledger Factoring: Annual Cost Comparison

Looking at the whole year:

- Selective factoring: $39,000

- Full ledger factoring: $75,150

By choosing selective factoring, the business saves about $36,000 a year. This example shows that in the case of seasonal businesses, savings often come from how much and how often they factor, not just the rates.

| Month |

Monthly Sales ($) |

Selective Factored ($) |

Selective Fee ($) |

Full Ledger Fee ($) |

|---|---|---|---|---|

| Jan | 220,000 | 100,000 | 3,250 | 4,950 |

| Feb | 210,000 | 100,000 | 3,250 | 4,725 |

| Mar | 240,000 | 100,000 | 3,250 | 5,400 |

| Apr | 280,000 | 100,000 | 3,250 | 6,300 |

| May | 320,000 | 100,000 | 3,250 | 7,200 |

| Jun | 350,000 | 100,000 | 3,250 | 7,875 |

| Jul | 360,000 | 100,000 | 3,250 | 8,100 |

| Aug | 340,000 | 100,000 | 3,250 | 7,650 |

| Sep | 310,000 | 100,000 | 3,250 | 6,975 |

| Oct | 260,000 | 100,000 | 3,250 | 5,850 |

| Nov | 230,000 | 100,000 | 3,250 | 5,175 |

| Dec | 220,000 | 100,000 | 3,250 | 4,950 |

| Total (Annual) | 3,320,000 | 1,200,000 | 39,000 | 75,150 |

When Selective Factoring Works for Seasonal Businesses

The case study above shows that selective factoring works best when cash needs are known and consistent, revenue fluctuates, but expenses do not, and flexibility is less important than keeping costs down.

When Full Ledger Factoring Could Be a Better Choice

When your business needs plenty of cash all the time, is growing and needs additional working capital, and flexibility is more important than cost, full ledger factoring can be a better option.

In conclusion, the best factoring setup depends on your business’s cash flow needs, not only on the factoring rates.

How We Help Seasonal Businesses Use Factoring in a Smarter Way

Managing seasonal cash flow requires a flexible strategy.

At Funding Explorer, we help business owners to:

- Figure out how much liquidity they really need.

- Decide when factoring adds value.

- Pick the structure that fits their cash flow patterns.

The goal is to only factor when it really helps your company, so your finance provides value without costing too much.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: January 30th, 2026

Business Funding Expert Insights

Not sure which factoring structure fits your seasonality?

If your sales rise and fall throughout the year, your financing strategy shouldn’t be one-size-fits-all. We help businesses compare selective and full ledger factoring based on real cash needs, not just rates.