Receivable Financing Guide: How It Works & Insider Tips

Receivable financing leverages the value of your outstanding invoices to obtain funding, helping to improve cash flow for your business.

This financial product is one of the most common forms of Asset-Based Lending (ABL), a type of alternative financing that uses business assets like receivables, inventory, or equipment as collateral for a loan.

The asset-based lending (ABL) market is experiencing rapid global growth. Valued at approximately $500 billion in 2023, it is projected to exceed $850 billion by 2032.

What is Receivable Financing?

Receivable financing is a special type of business loan that is secured by your accounts receivable. It functions as a flexible line of credit based on the accounts receivable balance, which updates as invoices are collected and new ones are issued.

It essentially converts your invoices into working capital while linking your financing directly to your sales.

Businesses commonly utilize these funds to improve cash flow, cover payroll, pay suppliers, address seasonal requirements, and support growth.

Who Uses Receivable Financing

Receivable financing is utilized by B2B companies, including manufacturers, distributors, service firms, and select retailers.

Typically, borrowers in this space have creditworthy customers, strong financials, and robust reporting systems.

Common scenarios for using receivable financing include:

- Businesses that have outgrown factoring but are not yet eligible for bank financing.

- Companies with strong collateral but weaker cash flow or credit ratios that do not meet bank standards.

- Borrowers seeking a greater borrowing capacity than what a bank line can provide.

Can Businesses That Sell to Consumers (B2C) Use Receivable Financing?

While most receivable financing is primarily for B2B companies, some B2C (consumer-oriented) companies can also qualify when they sell on credit terms and generate large, verifiable receivables. Some possible industry examples are:

- Healthcare – hospitals, clinics, dentists, and billing insurance.

- Private schools– tuition over months or semesters.

- Retail stores with in-house financing – furniture, jewelry, appliances.

- Trade schools – student payments by installment.

Lenders view receivables as reliable when they are backed by creditworthy payers, such as consumers financed through strong credit programs or solid third-party agreements.

Businesses with cash or credit card sales, such as restaurants, hotels, and certain contractors, generally don’t qualify.

How Does the Receivable Financing Process Work?

The typical process involves the following steps:

- Set Up the Account and Sign the Loan: Begin by establishing your account with the lender and signing the necessary loan documents.

- Report Your Receivables: You provide the Asset-Based Lender with a short report called a borrowing base certificate. This document is used to define the amount you can borrow. It’s important to note that you do not need to send every individual invoice; most lenders do not require them.

- Get Funding: The lender will calculate your borrowing availability based on the report you submitted. You can then request the funds, and the lender will wire or use ACH to transfer the money into your bank account.

- Customers Pay to the Lockbox: Your customers will continue to make payments as usual, but these payments are typically required to go to a special bank account controlled by the lender, known as a lockbox.

- Payments Reduce the Loan and Free Up Credit: The payments made by your customers will pay down your loan balance. This, in turn, adds back to your availability, allowing you to draw additional funds. Keep in mind that there is no per-invoice “leftover check”; this operates as a revolving line of credit, not a per-invoice sale.

- Ongoing Checks: You are required to continually submit the borrowing base and aging reports on a regular schedule. Lenders also conduct audits, often on a quarterly basis.

Insider Insight

Even after a customer’s check hits the lockbox, lenders often wait 1–3 days for it to officially clear before crediting your account. During this “float” period, interest and fees are still running.

How Big is the Line of Credit That Your Business Can Get

When a business borrows money through receivable financing, the lender looks at something called the borrowing base. This is like a scorecard that shows how much the company has in accounts receivable which can be used as collateral. Not everything counts—things like overdue invoices, disputed bills, or contra-accounts, related-party sales, and possible customers with high concentration get left out.

Insider Insight

Even if you sell to a big, creditworthy customer like Walmart or Target, lenders usually won’t let that customer’s invoices make up more than 30% of your borrowing base. If one customer is too big, part of their receivables might be excluded from availability.

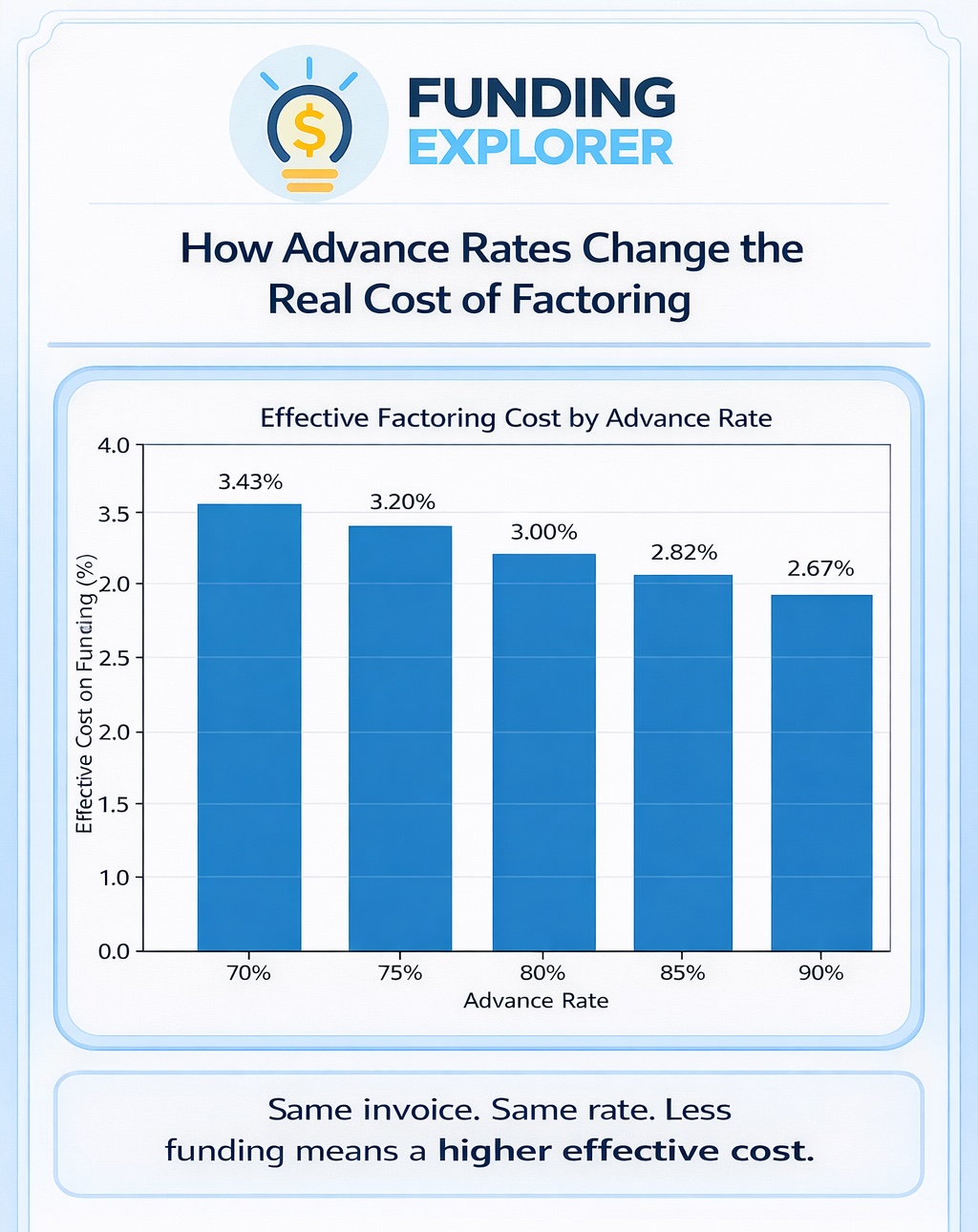

From this borrowing base, the lender calculates the availability, which is the actual amount of cash the company can use. Usually, this is about 70–85% of the eligible invoices. Then the lender subtracts anything already borrowed and other reserves.

Because it works like a revolving credit line, the amount a business can borrow goes up and down with sales and collections:

- When the company makes more sales, the borrowing base grows, and it can borrow more.

- When customers pay their invoices, the loan balance goes down, and new borrowing room opens up.

To keep this updated, the company fills out a Borrowing Base Certificate, which is a simple report that lists invoices, what’s ineligible, how much is available, and the current loan balance.

This cycle creates flexible, ongoing working capital that adjusts with your sales.

Summary: the borrowing base sets the limit, the availability shows the cash that’s ready today, and the certificate keeps everything current.

How Does Receivable Financing Compare to Factoring and Bank Loans?

Receivable financing lies between factoring and traditional bank loans, offering unique advantages for businesses. It provides greater flexibility than banks while being more cost-effective and private compared to factoring.

Compared to Bank Loans

- More expensive – You’ll usually pay higher interest and fees than with a regular bank line.

- More accessible – Banks often say no if a company is growing fast, has weak ratios, or hasn’t been around long. Receivable financing can still work in those cases.

Compared to Invoice Factoring

- Cheaper– The cost is usually lower than factoring, which takes a bigger cut.

- Less accessible – Lenders ask for more paperwork, financial statements, and audits before giving approval.

- Non-notification – Customers don’t get notified, so it keeps the relationship confidential. With factoring, customers know a third party is collecting.

- Loan vs. Sale – Here, you’re borrowing against receivables. With factoring, you’re selling them.

- Some B2C Qualify – A few consumer businesses that sell on credit (like furniture or jewelry stores) may qualify, which doesn’t happen with factoring.

Ready to see how much funding your business could access?

Contact our expert today to explore the best funding solution and find the right lending partner for your needs.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: September 18th, 2025

Business Cash Flow Expert Insights

Get Expert Guidance at No Cost

Skip the confusion and wasted time. Our team, backed by 20+ years of finance and consulting experience, will connect you with funding that works for your business.