Non-recourse factoring can protect your business from certain customer credit losses, but that protection comes at a premium, and it does not apply to every invoice or every situation.

In this article, we break down what non-recourse factoring actually covers, why it costs more, and how to evaluate whether the premium makes sense based on your customers, margins, and risk exposure. If you’re unsure if non-recourse is worth the extra cost, this will help you decide.

Non-recourse factoring might look simple at first.

You sell your invoices, and if your customer does not pay, you are not held responsible. There are no buybacks, no surprises, and no losses.

In practice, it is more complicated than it first appears.

Non-recourse factoring does not cover every invoice, customer, or situation. Coverage depends on insurance approvals, underwriting decisions, and exclusions that are not always clear at the start. This protection usually costs more, and it is not always as broad as business owners expect.

Before deciding if the premium is worth it, it is important to understand what non-recourse factoring really means.

What Is Non-Recourse Factoring?

Non-recourse factoring is a type of invoice factoring where some customer credit losses are not passed back to your business. Instead, the credit risk is usually transferred to a third-party credit insurer, not taken on directly by the factoring company.

With this setup, the factoring company funds invoices that meet insurance and underwriting rules. The insurer decides which customers and invoices qualify for coverage.

It is best to think of non-recourse factoring as transferring risk through insurance, not as a guarantee that every invoice will be paid.

What Events Are Actually Covered Under Non-Recourse

The term non-recourse is often used broadly, but coverage can vary a lot between agreements.

Some non-recourse structures protect against many types of credit events, while others only apply in specific situations. In many cases, non-recourse protection only covers customer bankruptcy or formal insolvency, not general failure to pay.

This difference is important.

If a customer stops paying but does not file for bankruptcy, the invoice may still be considered collectible under the agreement. In these cases, the business may still be responsible, even if the arrangement is called non-recourse.

Because non-recourse protection usually depends on third-party credit insurance, the scope of coverage depends on the insurer’s definitions, triggers, and exclusions. These terms can vary by policy, customer, and industry.

This is why it is important to know what event actually triggers coverage, not just whether an agreement is called non-recourse.

Why Non-Recourse Factoring Costs More

Factoring rates depend on risk. When your business transfers credit risk, someone else takes it on.

In non-recourse arrangements, this risk shows up as higher fees, lower advance rates, or stricter approvals. The extra cost covers the price of insuring your receivables and the limits set by insurers.

This pricing is not random. It reflects the cost of moving a specific risk out of your business.

Not Every Business (or Customer) Qualifies for Non-Recourse Factoring

It is also important to know that non-recourse factoring comes with conditions.

Since coverage relies on third-party credit insurance, insurers decide which customers qualify, how much risk is allowed, and whether coverage stays in place. Some customers may never qualify, while others may qualify at first but lose approval later.

Because of this, many businesses use a mix, with some invoices covered by non-recourse and others by recourse factoring.

This limitation is important when you are deciding if the premium is worth it.

A Simple Cost–Benefit Example

To see how the premium works in real life, let’s look at a simple example.

Assume a business factors $2.4 million per year.

- Recourse factoring rate: 2.00%

- Non-recourse factoring rate: 2.75%

- Premium for non-recourse: 0.75%

Annual cost comparison

- Recourse cost: $48,000

- Non-recourse cost: $66,000

- Annual premium paid: $18,000

The choice really comes down to one question: Is it likely that customer credit losses will be more than $18,000 per year?

If you expect losses to be much less than that, non-recourse factoring may not be needed.

If one default could cost more than $18,000, then paying the premium might make sense.

Recourse vs Non-Recourse Factoring: Cost Comparison Example

| Item | Recourse Factoring | Non-Recourse Factoring |

|---|---|---|

| Annual invoices factored | $2,400,000 | $2,400,000 |

| Discount rate | 2.00% | 2.75% |

| Annual factoring cost | $48,000 | $66,000 |

| Additional annual cost | — | $18,000 premium |

| Credit loss protection | No | Yes (insured invoices only) |

| Best fit for | Can absorb losses | Seeking credit-risk protection |

When Paying the Premium Can Make Sense

Sometimes, non-recourse factoring is a smart way to manage risk.

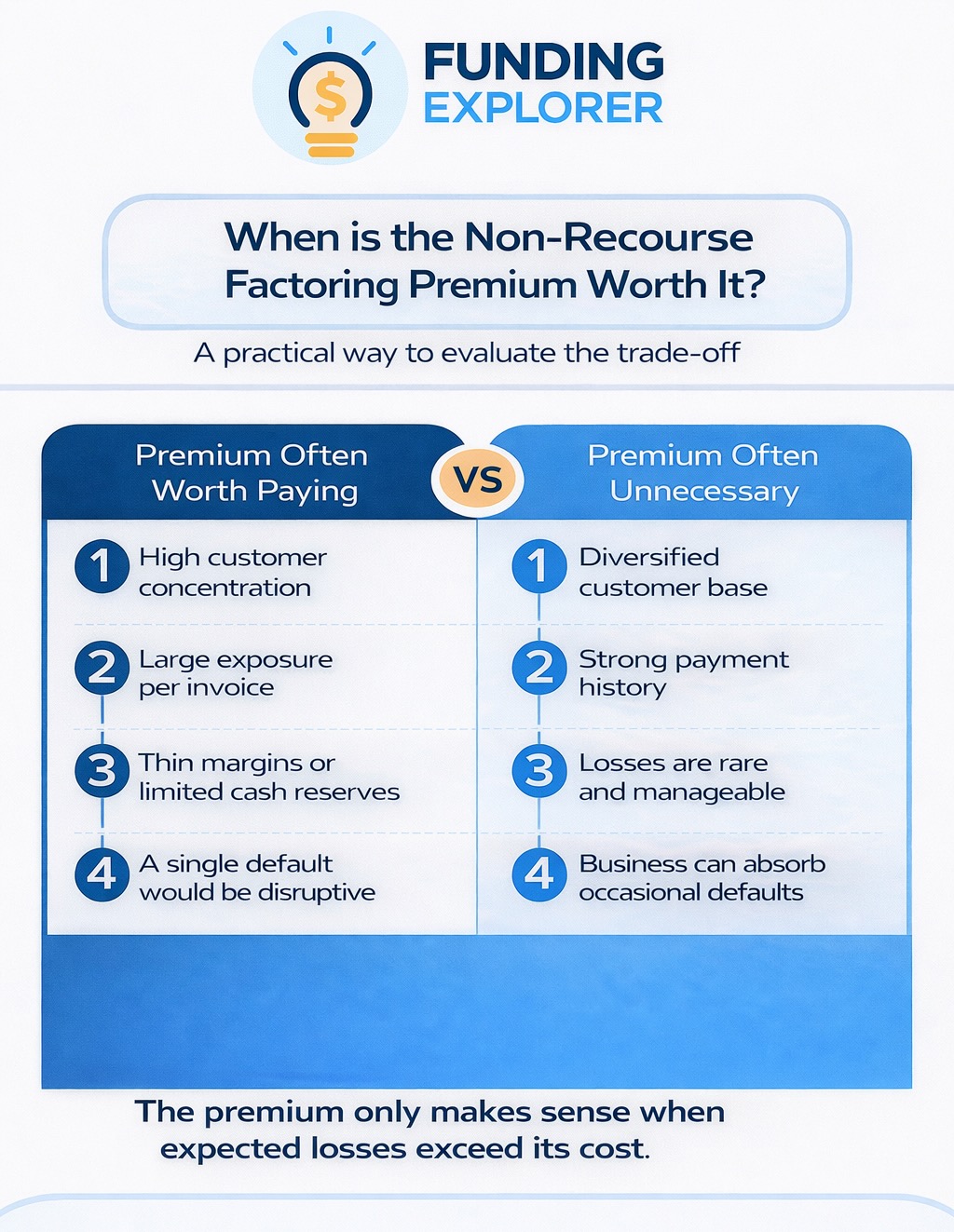

You might want to consider it when:

- A small number of customers represent a large share of revenue.

- A single default would materially hurt the business.

- Customers operate in volatile or cyclical industries.

- Margins are thin, and losses cannot be absorbed easily.

In these situations, the premium acts like insurance against rare but serious losses.

When Non-Recourse Factoring May Be Unnecessary

In other situations, the premium may not be worth it.

Non-recourse factoring is usually less appealing when:

- Receivables are well diversified.

- Customers have a long, consistent payment history.

- Write-offs are rare and manageable.

- The business can absorb occasional losses without stress.

In these cases, the cost of protection might be more than the risk you are actually moving.

Deciding If the Non-Recourse Premium Is Justified

In the end, the decision is about the numbers and how much risk you are comfortable with.

Non-recourse factoring is worth the premium only if the expected cost of credit losses under a recourse structure exceeds the additional cost of insurance. When losses are unlikely or manageable, the premium may not deliver meaningful value. When exposure is concentrated or a single default would be disruptive, paying for protection can be a rational choice.

The most important thing is to be clear. Knowing how much risk you are really taking and how much you are paying for it matters more than the agreement’s name.

At Funding Explorer, we help business owners see what they are paying for and whether it matches their real risks before choosing a factoring option. If you are paying a non-recourse premium and are unsure if it is right for you, reviewing your receivables and pricing can often give you a clear answer.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: January 28th, 2026

Business Funding Expert Insights

Unsure If the Premium Is Worth It?

Non-recourse factoring only makes sense when the cost matches the risk.We can help you review your receivables and pricing to see if the premium aligns with your exposure.