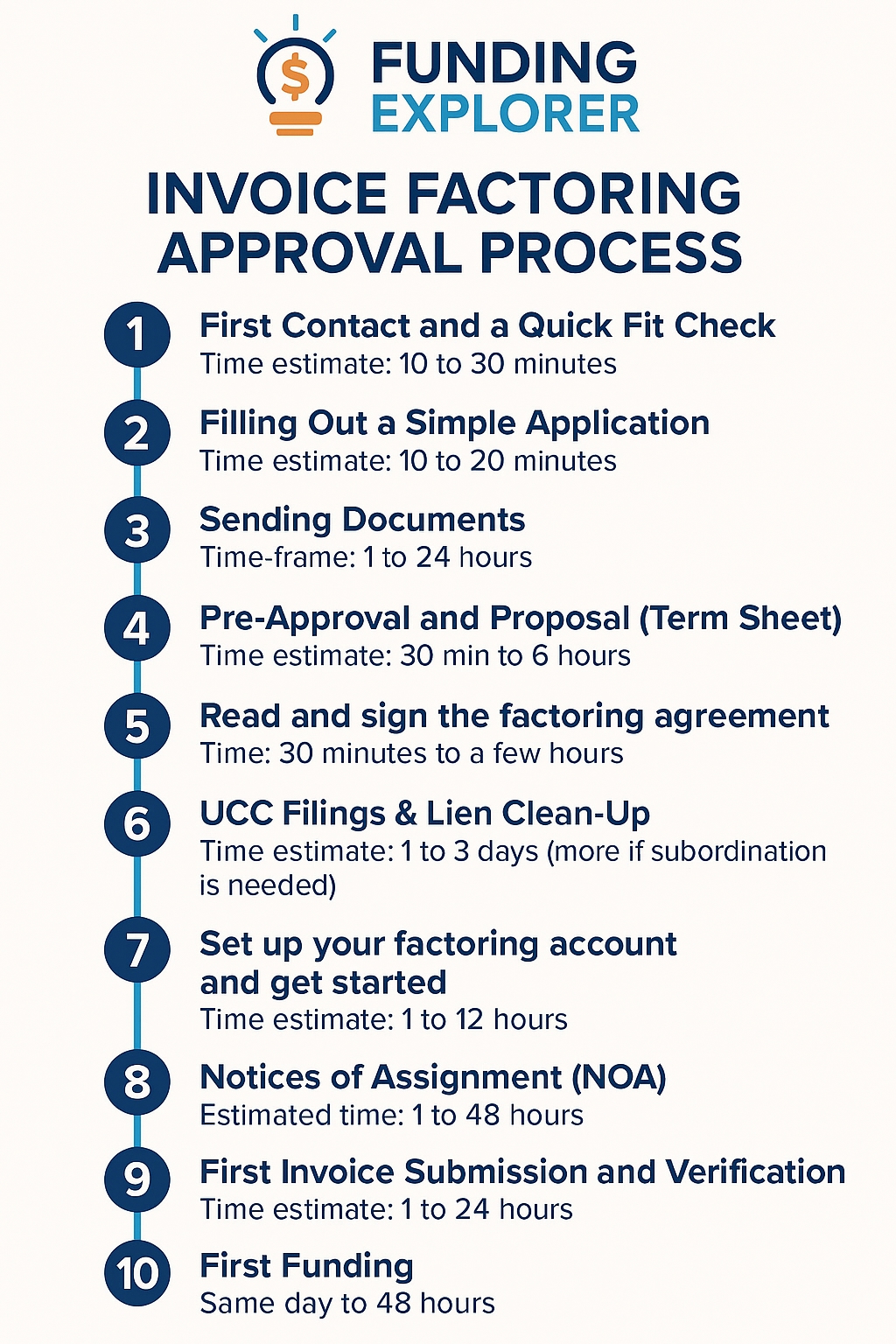

The Full Invoice Factoring Approval Process Explained: From the First Contact to the First Funding.

A clear, step-by-step guide that tells you exactly what to expect and how to get money as quickly as possible.

Why It's Important for the Factoring Approval Process to Be Quick

You probably want to improve your cash flow quickly if you’re thinking about invoice factoring:

- It’s time for payroll.

- You need to pay the drivers or staff

- You need to pay your supplier or fuel bills.

- You don’t want to wait 30, 60, or 90 days for customers to pay anymore.

You don’t have time to guess how things work.

This guide takes you through every step from the first contact to the first funding, in the order that they usually happen:

- Getting in touch with a factoring company (or better yet, a broker)

- Filling out a short application

- Sending in papers

- Getting a pre-approval and a proposal

- Signing the factoring contract

- Checking the UCC and liens

- Setting up an account

- Notices of Assignment (NOA)

- First submission and verification of invoices

- First funding

You will also learn how working with a factoring broker like Funding Explorer can help you avoid days of delays.

Step 1: First Contact and a Quick Fit Check

Time estimate: 10 to 30 minutes

This step usually involves filling out an online quote or lead form and having a short phone call conversation.

The factor (or broker) will want to know:

- What kind of work do you do?

- Who your main customers are

- What do you bill each month?

- What you need funding for

- How long does it take for your customers to pay?

- How quickly do you need money

- If your invoices are for work that has been done

Why is this step important?

Factoring companies have a specific area of expertise. Some factors love freight. Some focus on staffing. Some won’t work with construction, healthcare staffing, or billing based on milestones. Some won’t buy invoices for small amounts. There is no point in going forward if there is no basic fit.

How a Broker Like Funding Explorer Can Help

You don't have time to call several factoring companies and hear "no" for different reasons when you're under pressure, especially for payroll.

A good factoring broker already knows:

- Which factors are good for your industry?

- Which ones are attracted to your customer profile

- Which ones can move quickly?

- Which ones fit the size and volume of your invoices

- Which ones take into account prospects with unique circumstances, such as start-ups, problems with customer concentration, rapid growth, seasonal spikes, and problems with owner background, etc.?

A broker ensures your request goes straight to a factor likely to approve and fund you quickly, instead of wasting days with the wrong companies.

And the best part…there’s no fee or additional cost to you!!

Step 2: Filling Out a Simple Application

Time estimate: 10 to 20 minutes

If you’re a good fit, you’ll be asked to fill out a short online application.

The application typically asks for company and ownership information, such as:

- Basic business information, such as the legal name, address, and owners

- How to get in touch

- How long have you been in business?

- Your main customers and contact information

- Average size of invoices and number of invoices per month

- How your billing works and the NET terms you give

- Any loans, liens, or MCAs that are already in place

This information gives the factor a clear picture of your business so they can assess risk and make a possible proposal.

Where Brokers Can Help

A broker will help you fill this out correctly and organize your file from the start so that the factor doesn't get confused about your business and slow things down with questions that don't need to be asked.

Simplify the entire approval process. Get expert help in minutes.

Step 3: Sending the Documents That Support Your Application

Time estimate: 1 to 24 hours, depending on your organization

The factoring company will ask for supporting documents along with the application.

Some common requests are:

- Aging report for accounts receivable

- Report on the aging of accounts payable

- List of customers with their contact information

- A few sample invoices

- Contracts, purchase orders, or rate confirmations

- Recent bank statements

- Sometimes a simple P&L (usually for bigger places)

Typical reasons for delays:

- AR aging that is missing or not complete

- A list of customers without any contact information

- Documentation that isn’t clear or is poorly organized

How Funding Explorer Can Help

A broker helps you send in a clean, complete package the first time, which is very important when you're trying to meet a payroll deadline. This way, you don't have to send documents in pieces and get endless requests for "one more thing."

We’re here to guide you every step of the way.

Step 4: Pre-Approval and Proposal (Term Sheet)

Time estimate: 30 minutes to 6 hours after getting the documents

After the factor looks over your application and basic paperwork, they will either give a proposal, a term sheet, or turn down the application.

The proposal usually includes:

- Expected advance rate (for example, 80% to 95%)

- Proposed rate

- Size of the facility

- Length of the contract

- Minimums (if any)

Important: This proposal is based on information the underwriter has at the time the application is received. Final approval still depends on liens, the customer’s review, and whether the invoices are eligible.

In this step, you’ll know:

- How much money can you get

- How much will it cost

- If the offer meets your needs

You now have to choose whether or not to go ahead with that factor.

How a Broker Like Funding Explorer Can Help

A broker can:

- Make sure the proposal works for your situation.

- Help you look at different proposals (if you want to)

Want to avoid delays? Let a Funding Explorer match you with the right factor the first time.

Step 5: Read and sign the factoring agreement (the contract)

Time estimate: 30 minutes to a few hours, depending on your questions and how fast you are willing to sign.

If you accept the proposal, the factor sends you (and your partners, if you have any) a factoring agreement to sign.

The agreement includes:

- Advance rate

- Fee structure

- Reserve percentage

- Recourse vs. non-recourse terms

- Notification terms

- Termination clause

- Minimum volume

- Additional fees (wire, due diligence, etc.)

This is where both sides commit:

- You agree to sell eligible invoices

- The factor agrees to fund them according to the agreement

Where a Broker Can Help

Before you sign, a broker can:

- Help you understand the key terms

- Flag anything unusual

- Make sure the contract aligns with your goals

Get answers fast, avoid mistakes, and move forward with confidence.

Step 6: UCC Filings & Lien Clean-Up

Time estimate: 1 to 3 days (3 to 10 days if subordination is needed)

After the agreement is signed, the factor performs deeper lien and UCC checks.

They will:

- Run a UCC search

- Look for existing liens (banks, MCA lenders, other factors)

- Check tax liens or judgments

- Verify your legal entity name and state

If there’s an issue, the factor may request:

- UCC subordination

- Lien release

- Intercreditor agreement

Factors cannot fund until they have first position on your receivables.

Typical Bottlenecks

- Old UCC filings have not been terminated

- Banks are slow to respond

- MCA lenders are refusing to subordinate

- Name/EIN mismatches

This is probably one of the slowest steps.

Step 7: Set up Your Factoring Account and Get Started

Time estimate: 1 to 12 hours

At this point:

- Your client profile is activated

- Your customers are connected to your account

- A lockbox to receive payments is set up

- You now have access to your online portal.

- You can now start selling invoices.

Step 8: Notices of Assignment (NOA)

Estimated time: 1 to 48 hours, depending on how quickly the customer (debtor) responds.

The factor sends your customers a Notice of Assignment.

The NOA:

- Informs customers that receivables are assigned to the factor

- Provides payment instructions

- Ensures future payments go to the correct lockbox

Why does the factor send NOAs

- To prevent misdirected payments

- To ensure legal collection rights

- To protect against disputes later

How customers typically react

Most large companies and AP teams see NOAs every day.

Industries like:

- Transportation

- Staffing

- Manufacturing

- Government contracting

…use factoring constantly.

Smaller customers may have questions but usually accept it once explained.

Step 9: First Invoice Submission and Verification

Time estimate: 1 to 24 hours

You send your first batch of invoices.

You’ll typically provide:

- The invoices

- Proof of delivery, signed timesheets, or supporting documents

- Contracts, rate confirmations, or POs (if applicable)

What does the factor do

- Checks accuracy

- Confirms work was completed

- Matches invoice to contract/PO

- May verify directly with the customer

This is the final safety check before money is advanced.

Common last-minute delays

- Missing POD/sign-offs

- The invoice does not match the contract terms

- Unexpected customer disputes

- Trying to factor very old invoices

Step 10: First Funding

Time estimate: Same day, 48 hours after receiving your invoices

Once your invoice batch is verified:

- The factor advances the agreed percentage (e.g., 85%)

- The remaining reserve is released after your customer pays

- The factor subtracts fees and sends the remainder to your bank

How fast does funding happen

If everything is clean:

- Many businesses get funded within 24–48 hours

- Some get same-day funding

When documents, lien issues, or verification are slow, it can take longer.

After this, the daily funding cycle becomes much smoother and faster.

The Big Picture: What to Expect

If you’re responsive and paired with the right factor:

- Most approvals happen in 1–7 days

- Many funds are within 24–48 hours of completion

The biggest delays are caused by:

- Choosing the wrong factor

- Documents that are missing

- Conflicts over liens

- Customers who don’t respond quickly

Once you’re set up, factoring turns slow-paying invoices into consistent working capital, especially useful for payroll and urgent expenses.

If you want the fastest approval with the right factor, we’re here to help.

Quick Questions and Answers About The Factoring Approval Process

How long does the whole process usually take?

Usually 1 to 7 business days, depending on the documents, the status of the liens, and whether the customer received the NOA.

Will my clients think something is wrong?

No. Every day, big businesses deal with factoring. It’s a tool for managing cash flow.

When is the broker involved?

Only before and during approval, helping you avoid delays and match with the right factor. After you sign the agreement, your relationship continues directly with the factor.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: December 15th, 2025

Invoice Factoring Expert Insights

Get Expert Guidance at No Cost

Your situation is unique; we’ll guide you to the factoring company that fits best.