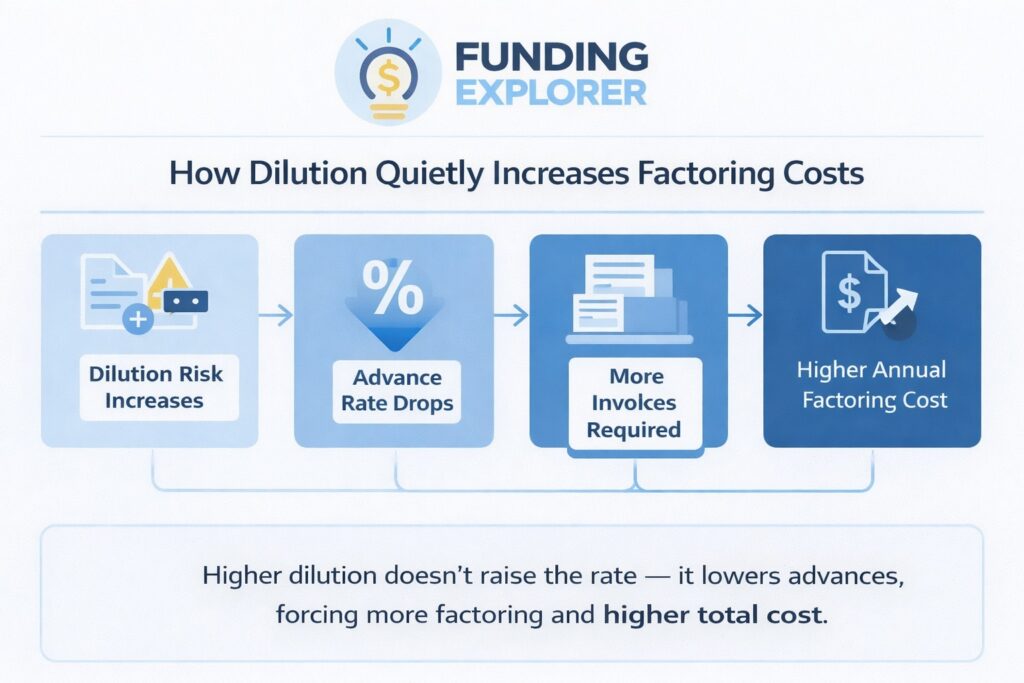

How Risk and Dilution Quietly Increase Factoring Costs

Dilution affects more than collections. It directly influences advance rates, usable cash, and total factoring cost. This article explains how higher dilution can quietly force businesses to factor more invoices and pay higher fees, even when the factoring rate stays the same.