Summary

Factoring cost depends on more than the rate and advance. Other fees, sometimes called “hidden fees,” driven by how factoring is used, including funding frequency, invoice volume, and account structure, can significantly affect total cost over time.

This article explains which costs matter and offers a simple way to evaluate factoring proposals based on real business needs.

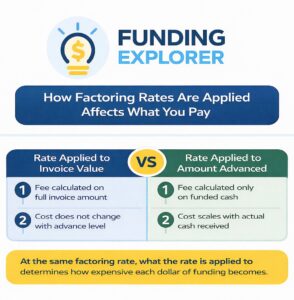

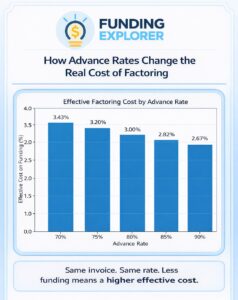

When businesses compare factoring offers, they usually focus on two numbers: the factoring rate and the advance rate.

That makes sense. Those are the most visible parts of a proposal, and they feel like the primary drivers of both cost and cash access. But many businesses are surprised later when their total factoring cost doesn’t align with what those two numbers seemed to suggest.

The reason is simple: factoring costs are not defined solely by the rate and advance.

Beyond those headline figures, factoring agreements often include additional charges tied to how often you fund, how many invoices you submit, and how the account is structured. These costs are not hidden in the sense of being secret; they are disclosed in the contracts you sign, but they are often not fully modeled when proposals are compared.

In some cases, these additional costs can increase the effective cost of factoring by another 0.5% to 1% or more annually, depending on how the facility is used.

Understanding these costs doesn’t mean factoring is expensive or unfair. It means the structure needs to match how your business actually operates.

A Clarification About Factoring “Hidden Fees”

You’ll often see non-rate factoring costs described online as “hidden fees.” That language has largely come from factoring companies or invoice financing companies trying to differentiate themselves from competitors.

In reality, most of these fees are not hidden.

They are typically:

- outlined in the factoring agreement,

- disclosed in fee schedules or exhibits,

- and agreed to when the contract is signed.

The actual problem isn’t “hidden costs”; it’s context.

These fees are rarely highlighted in initial quotes, and their impact is often not projected based on real usage. That’s why businesses are sometimes surprised later, even though the fees were technically disclosed.

More Factoring Fees Do Not Necessarily Mean Higher Final Factoring Costs

It’s also important to be clear about this: more fees do not automatically mean a higher total cost.

Some factoring companies charge:

- lower discount rates, but

- more usage-based fees

Others charge:

- higher rates, but

- fewer additional charges

Either structure can be cheaper depending on how often you fund, how much you factor, and how consistent your cash needs are.

That’s why numbers matter more than labels.

The Main Categories of Factoring Costs Beyond the Factoring Rate

Not every agreement includes all of these fees. What matters is understanding which ones apply to your usage pattern.

One-Time Setup and Onboarding Costs

These costs cover the initial setup work for your factoring account.

This category includes fees like the following:

- setup or onboarding fees

- due diligence or credit review fees

- legal or documentation charges

These costs typically matter more for short-term relationships and less for long-term facilities.

Variable Fees Per-Funding Transfer

These are among the most common recurring costs and often have the biggest real-world impact.

For example:

- ACH transfer fees (commonly $5–$15 per funding)

- wire transfer fees (often $20–$50 per funding)

These fees apply each time funds are sent, not based on invoice size. Businesses that fund frequently will feel these costs more than businesses that fund occasionally.

Variable Per-Invoice or Processing Fees

Some factors charge fees tied to invoice handling rather than the funding amount.

For example:

- invoice processing fees

- transaction or submission fees

- lockbox or payment processing charges

These matter most to businesses that submit many small invoices.

Recurring Monthly Maintenance or Service Fees

These are flat or semi-flat charges related to account maintenance.

Examples:

- monthly service fees

- account management charges

- reserve maintenance fees

They apply no matter how much is factored every month.

Conditional Minimum Volume or Minimum Fee Charges

Some agreements require:

- a minimum monthly factoring volume, or

- a minimum monthly fee

If the minimum isn’t met, the difference is charged. For businesses that consistently meet volume, these fees rarely apply.

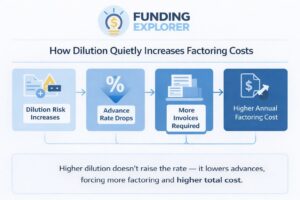

Situational Payment-Timing and Dilution-Related Fees

Some factoring agreements include additional costs if collections take longer than expected, invoices become delinquent, or short payments are received.

For example:

- extended aging charges

- rate step-ups after a set number of days

- fees related to charge-backs, disputes, credits, or short payments

These are tied to customer behavior and billing quality. We’ve covered dilution and its impact on cost in depth in a separate article, but it’s an important variable to keep in mind here.

Termination or Buyout Fees (Exit-Related)

These only apply if a business exits the factoring relationship early.

For example:

- penalties for early termination

- buyout dependent on the amount of time left or the factored volume

These fees are particularly significant when you need flexibility or are planning to use factoring for short-term financing.

Why These Factoring Costs Are a Big Deal for Some Businesses, But Not For Others

The key is not the number of fees, but how they interact with usage.

A company that:

- funds frequently,

- submits many small invoices,and d

- uses factoring for short-term gaps

will feel per-funding and per-invoice fees much more than a business that:

- funds less often,

- factors larger invoices, and

- uses factoring consistently

This is why two businesses with the same rate and advance can experience very different total costs, and why comparing proposals without modeling usage leads to frustration and wrong conclusions.

Factoring Fee Impact by Usage Pattern

| Fee Category | Matters Most When… | Often Minimal When… |

|---|---|---|

| Funding & Transfer Fees | Funding is frequent or same-day transfers are common | Funding is less frequent and scheduled |

| Invoice & Processing Fees | Many small invoices or high transaction volume | Fewer, larger invoices with simple documentation |

| Monthly & Minimum Fees | Usage is inconsistent or seasonal | Volume is consistent and predictable |

| Timing & Dilution Fees | Customers pay late or invoices are disputed | Receivables pay consistently within terms |

| Setup & Exit Fees | Factoring is short-term or flexibility is critical | Factoring is long-term and stable |

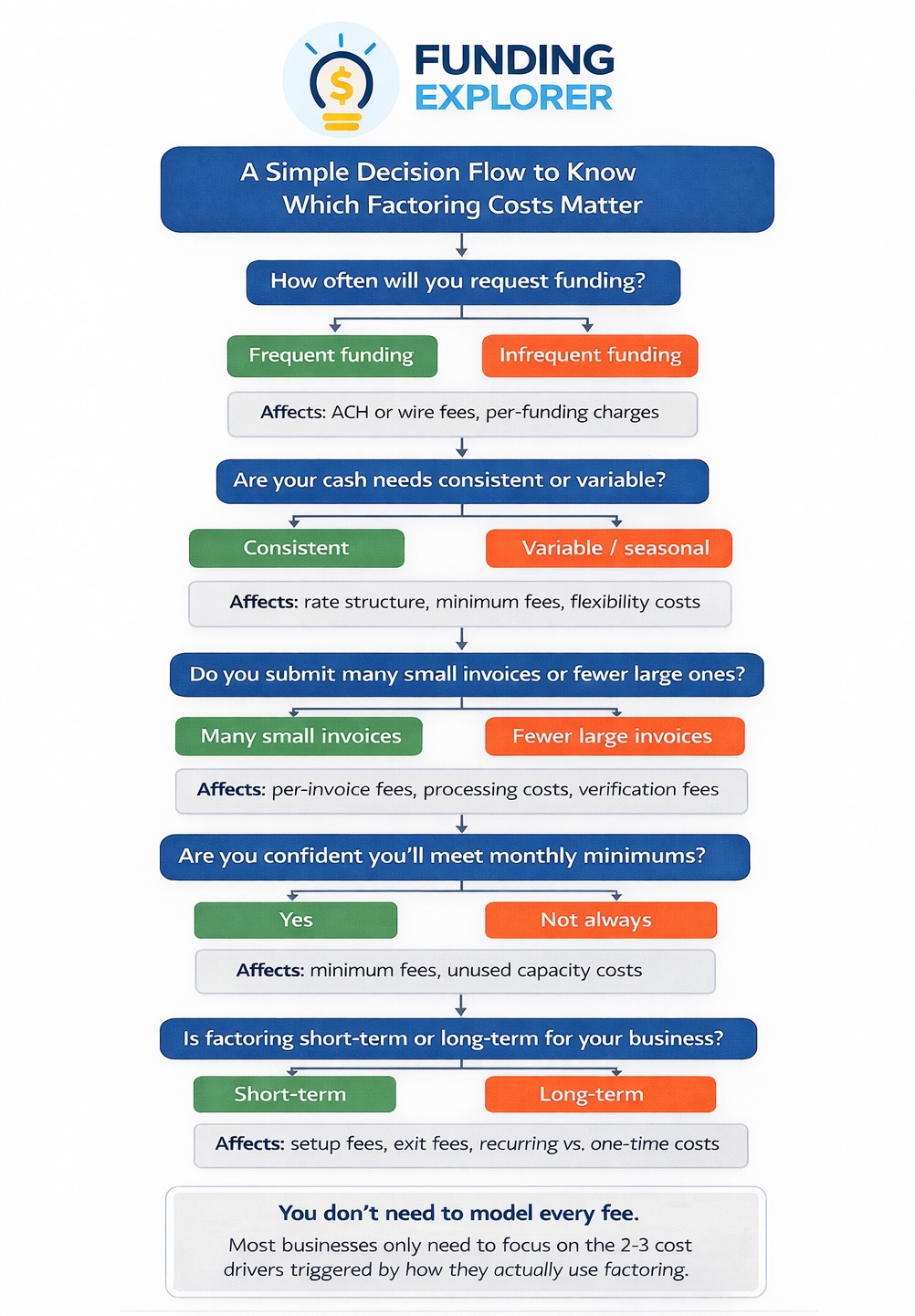

A Simple Decision Flow to Know What Actually Matters

Instead of trying to account for every possible fee, start with these questions:

1. How often will you request funding?

If funding is frequent, then transfer and processing fees matter more.

2. Are your cash needs consistent or variable?

If your needs are consistent, then the rate structure and advances matter more.

If you have variable needs, then flexibility and minimums matter more.

3. Are you selling many small invoices or a few large ones?

If the invoice amounts are small, the per-invoice fees can be significant.

4. Are you confident that you will be able to meet any minimums?

If you usually meet the minimums, these fees may never apply.

If you are not sure, then these fees should be modeled in your evaluation.

5. Is this short-term or long-term financing?

If you will be factoring for a short term, then setup and exit fees matter more.

If you are planning to factor for the long term, then recurring costs are more important than one-time fees.

Most businesses only need to analyze two or three of these variables to estimate their real cost.

How Funding Explorer Helps Analyze Factoring Costs

Factoring only feels complicated when numbers are reviewed in isolation.

At Funding Explorer, we help business owners step back and evaluate factoring options based on how they actually plan to use the facility, not just what the proposal looks like.

We help you:

- Estimate realistic funding frequency.

- Project invoice volume and cash needs.

- Identify which fees are likely to apply and which won’t.

- Compare offers based on projected annual cost, not just factoring rates.

In many cases, this process shows that:

- Some fees never come into play,

- Some higher-rate structures cost less overall, and

- Some “cheaper” proposals quietly become expensive once usage is modeled.

The goal is to help you choose a structure that supports your cash flow without incurring unnecessary costs.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: February 17th, 2026

Business Funding Expert Insights

Looking at Factoring?

Most factoring costs are driven by structure and usage, not just the rate. We help business owners evaluate options early and connect them with funding partners that fit their business and pricing needs.