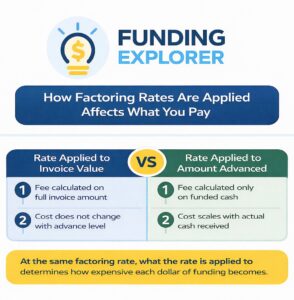

Many business owners believe the cost of factoring is all about the rate.

If the rate doesn’t change, the cost shouldn’t either. At least, that’s how it feels.

But many companies later realize they’re paying more than expected, even though the rate on their contract never changed.

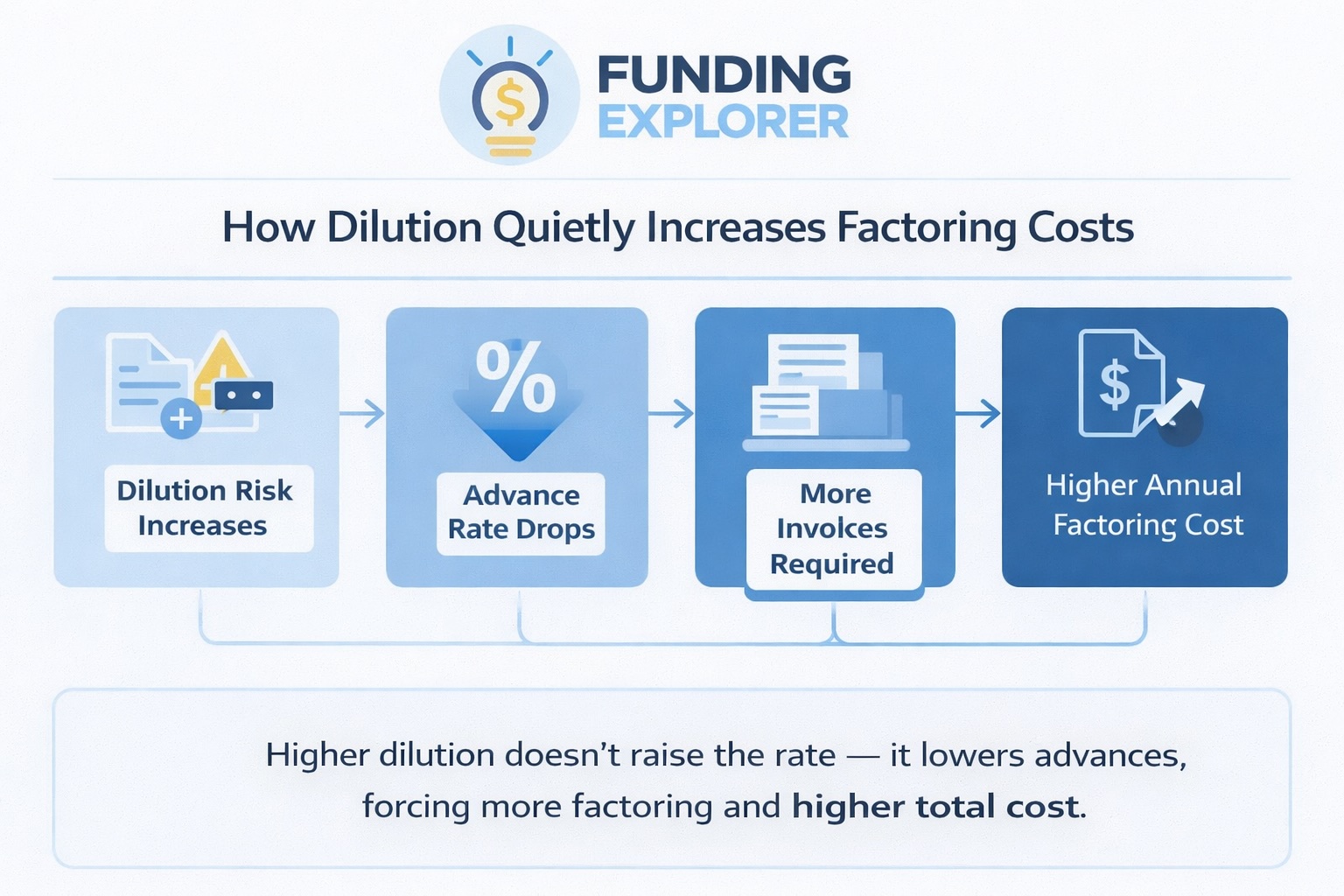

One of the main reasons is dilution.

Dilution doesn’t just affect collections. It quietly affects advance rates, how much cash you can actually use, and how much you end up paying over time.

What Dilution Actually Means in Factoring

In factoring, dilution is the difference between what you invoice and what is ultimately collected.

It usually comes from things like:

credits or price adjustments

- short payments

- disputes

- freight, fuel, or service deductions

- billing inconsistencies

This isn’t fraud, and it’s not bad management. Dilution exists in many healthy businesses.

What matters is that factoring companies price dilution risk into their advance decisions.

Why Dilution Affects Factoring Advances More Than You Might Expect

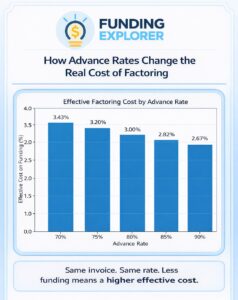

A common question businesses ask is, “If my dilution only increases a few percentage points, why does my advance drop so much?”

The answer is that dilution and advance rates don’t move proportionally.

Factoring companies don’t price based on average expected dilution. They safeguard themselves from timing gaps, worst-case scenarios, and operational uncertainty. As the risk of dilution rises, the factor needs a bigger buffer to avoid advancing too much.

That buffer comes from holding back more of the invoice value.

Because of this, advance rates often drop in steps rather than in small increments. A business moving from very low dilution to moderate dilution can see a meaningful reduction in advance, even if the dilution percentage still looks reasonable.

Once you understand that, the cost impact becomes clear.

How Dilution Affects Funding & Factoring Costs: Numeric Example

Let’s look at the same business operating under two different dilution profiles.

These are the assumptions for this example:

- Selective factoring (only invoices needed are factored)

- Amount Invoiced: $350,000

- Invoices initially factored: $200,000

- Factoring rate: 2.50% (charged on invoice value)

- Minimum cash needed: $180,000

Scenario A: Low Dilution Business

- Expected dilution: ~2%

- Advance rate: 90%

- Cash received: 90% × $200,000 = $180,000

- Monthly factoring fee: 2.50% × $200,000 = $5,000

In this case, the business gets all the cash it needs from the invoices it factored.

Scenario B: Higher Dilution Business

- Expected dilution: ~8%

- Advance rate: 75%

- Cash received: 75% × $200,000 = $150,000

- Monthly factoring fee: 2.50% × $200,000 = $5,000

Here, the business falls $30,000 short of its cash flow goal.

To get $180,000 in cash flow with a 75% advance, the company needs to factor more invoices.

- Required invoice volume: $180,000 ÷ 75% = $240,000

- Revised monthly factoring fee: 2.50% × $240,000 = $6,000

What Changed, and Why It Matters

The rate and fee percentage stayed the same. The only change was the advance rate, which decreased due to higher dilution risk.

Because of this, the business has to factor $40,000 more in invoices each month just to get the same amount of cash.

Let’s analyze the annual cost impact.

At the same 2.50% rate:

Low dilution scenario

- Monthly volume factored: $200,000

- Monthly fee: $5,000

- Annual factoring cost: $60,000

Higher dilution scenario

- Monthly volume factored: $240,000

- Monthly fee: $6,000

- Annual factoring cost: $72,000

This results in a $12,000 annual difference, caused only by dilution lowering the advance rate, not by a higher factoring rate.

| Metric | Low Dilution (~2%) | Higher Dilution (~8%) |

|---|---|---|

| Advance rate | 90% | 75% |

| Initial invoices factored | $200,000 | $200,000 |

| Cash received | $180,000 | $150,000 |

| Additional invoices required | — | $40,000 |

| Total invoices factored | $200,000 | $240,000 |

| Factoring rate | 2.50% | 2.50% |

| Monthly fee | $5,000 | $6,000 |

| Annual factoring cost | $60,000 | $72,000 |

A Note on Dilution

A natural question here is whether a business can influence dilution, and, therefore, advance rates.

Sometimes yes, sometimes no. Some dilution comes from correctable issues like billing errors or disputes. Other dilution is structural and common in certain industries, such as agriculture, food distribution, or apparel, where credits and adjustments are normal.

We’ll cover ways to manage and reduce dilution in another article.

Why Dilution Often Triggers Multiple Cost Pressures When Factoring

Lower advance rates usually bring other challenges, too.

When dilution risk increases, factoring companies often respond by keeping more money in reserves and increasing funding controls.

In addition, to get the cash flow it needs, the business has to request funding more frequently with additional per-funding costs (wires, processing fees)

Each minor change might not seem significant on its own, but together they add up and increase the total cost of financing.

This is why businesses with higher-than-normal dilution often feel that factoring “gets more expensive over time,” even though the rate on paper stays the same.

When The Factoring Structure Can Help Offset Dilution

Sometimes, using broader structures like full ledger factoring can lower perceived risk by spreading it across many customers and invoices. This can help you get higher advances and more funding.

But this strategy only works if factoring all your invoices matches your real cash needs. Factoring more invoices than you need can still raise your total costs, even if the advance rate is better.

How Funding Explorer Helps Businesses Model Dilution Risk

At Funding Explorer, we don’t treat dilution as just a number.

We look at how your clients pay, how often adjustments happen, and how these trends affect your advances, reserves, and total costs over time. We model alternative situations before you make a decision so you can understand how changes in advance levels and volumes influence your real annual cost.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: February 12th, 2026

Business Funding Expert Insights

The way you request proposals determines the cost you’ll pay.

We help you structure factoring correctly, then bring proposals from partners that fit, not from whoever answers first.