In invoice factoring, advance rates play a major role in determining real cost. Even when factoring rates are the same, different advance levels change how much cash a business receives, how much invoice volume must be factored, and how expensive each dollar of available funding becomes.

This article explains how advance rates affect effective factoring costs and why focusing only on the factoring rate often leads to misleading comparisons.

When businesses compare factoring offers, they almost always start with the rate.

A quote of 2.40% sounds cheaper than 2.75%, and it’s natural to assume that a lower rate means lower cost. Advance rates, on the other hand, are often treated as a secondary detail, something that affects funding amounts, not expenses.

That’s where many businesses get surprised.

Advance rates don’t just influence how much cash you get upfront. They quietly affect how much invoice volume you need to factor, how often you fund, and what factoring actually costs you over time.

Even when the stated rate is the same, a lower advance can increase your effective rate and your total annual cost.

Let’s walk through why.

What an Advance Rate Really Controls

The advance rate in invoice factoring determines how much of an invoice’s value a business can use immediately, with the rest released later after collection and fees.

The advance rate controls how much cash you receive upfront from each invoice.

- A higher advance puts more cash in your account immediately.

- A lower advance means more of your money sits in reserve when customers pay.

What matters operationally isn’t the invoice amount; it’s the usable cash you receive.

When advances are lower, businesses don’t just feel tighter on cash. They usually end up factoring more invoices to reach the same funding target. That’s where the cost starts to increase.

Same Rate, Different Cash Outcomes

Let’s start with a simple example using new numbers.

Invoice amount: $120,000

Factoring rate: 2.40%

(Assume the fee is charged on the invoice amount.)

Scenario A: 75% Advance

- Cash received: $90,000

- Factoring fee: $2,880

Scenario B: 90% Advance

- Cash received: $108,000

- Factoring fee: $2,880

Nothing about the rate changed. Nothing about the invoice changed. The fee didn’t change either.

But the amount of cash you can actually use did.

That difference becomes clearer when we look at effective cost.

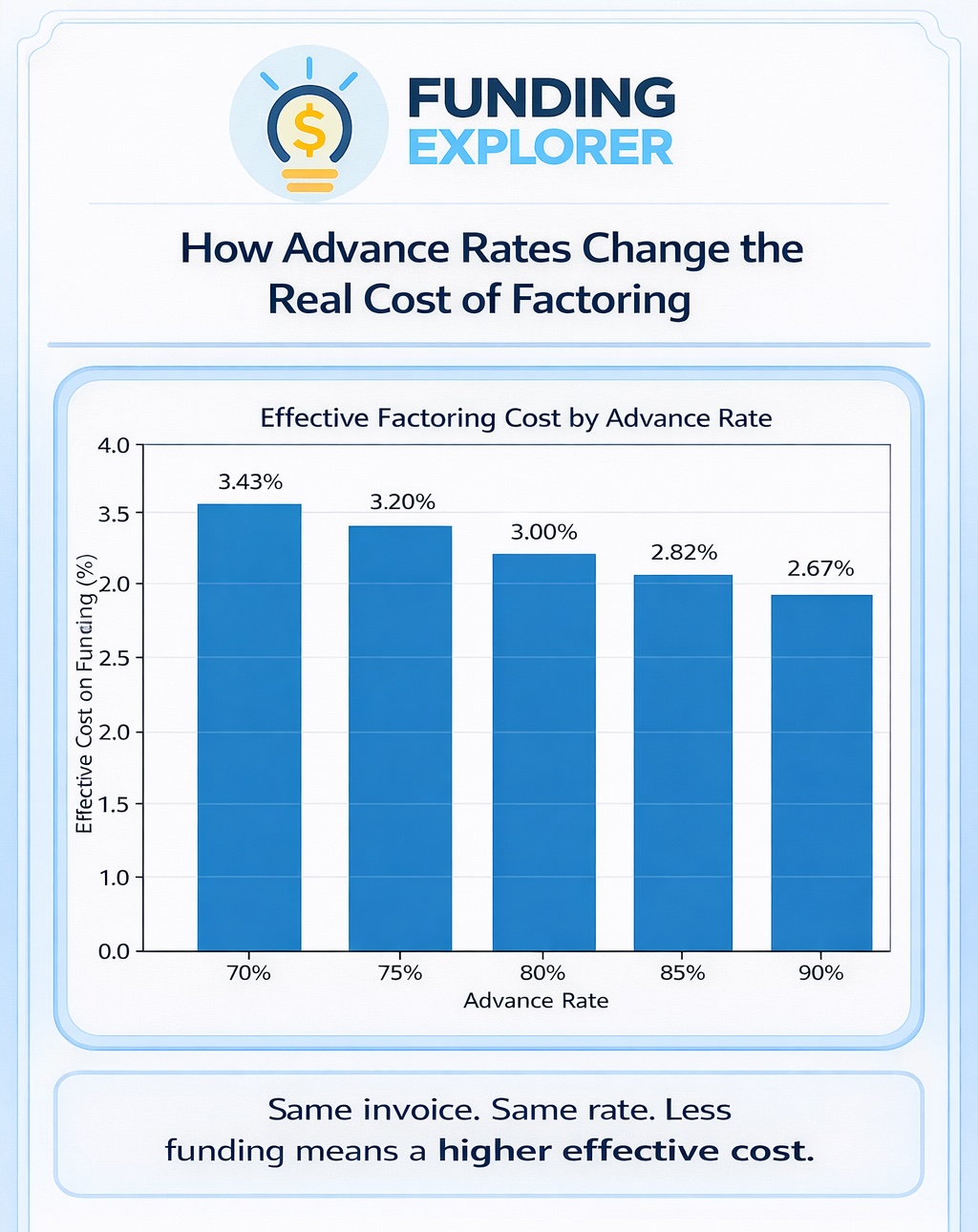

How Advance Rates Change the Effective Rate

Effective cost looks at what you paid relative to the cash you received.

Using the example above:

- 75% advance: $2,880 ÷ $90,000 = 3.20% effective cost

- 90% advance: $2,880 ÷ $108,000 = 2.67% effective cost

Same quoted rate. Very different effective rates.

Lower advances quietly make each dollar of usable cash more expensive.

Why Lower Advances Force You to Factor More

This effect becomes even more important in real operating scenarios.

Assume a business needs $100,000 in cash every month to cover payroll, inventory, and operating expenses.

With a 75% Advance

To receive $100,000:

- Required invoice volume: $133,334

With a 90% Advance

To receive $100,000:

- Required invoice volume: $111,112

That’s over $22,000 in additional invoices that must be factored each month to get the same funding amount.

Why does this matter? Because more volume means more fees.

How This Adds Up Over a Year

Now let’s look at what this means over time, using the same 2.40% rate.

75% Advance Scenario

- Monthly invoice volume: $133,334

- Monthly fee: $3,200

- Annual factoring cost: $38,400

90% Advance Scenario

- Monthly invoice volume: $111,112

- Monthly fee: $2,666

- Annual factoring cost: $31,992

That’s a $6,408 difference per year, driven entirely by the advance rate.

Effective Factoring Cost Comparison (All Examples)

Here’s how the numbers compare side by side:

|

Advance Rate |

Invoice Amount Factored |

Cash Received Upfront |

Factoring Fee Paid |

Effective Cost on Usable Cash |

|---|---|---|---|---|

| 75% | $120,000 | $90,000 | $2,880 | 3.20% |

| 90% | $120,000 | $108,000 | $2,880 | 2.67% |

| 75% | $133,334 | $100,000 | $3,200 | 3.20% |

| 90% | $111,112 | $100,000 | $2,666 | 2.67% |

Why Advance Rates Vary

Advance rates are influenced by perceived risk, including customer concentration, invoice disputes or credits, short payments, inconsistent billing, and spot or one-off factoring activity, topics we’ll break down in detail in a separate article.

Lower advances may make sense from a risk perspective, but they also change how much cash a business can access and how much it ultimately pays to get it.

How Funding Explorer Helps

Advance rates don’t just affect timing; they influence how much you have to factor, how often you fund, and how expensive each dollar of working capital becomes.

At Funding Explorer, we help business owners step back and evaluate factoring offers based on how they actually operate. Instead of focusing on a single percentage, we look at advanced levels, cash requirements, expected funding volume, and how those variables interact over time.

The goal is simple: make sure the structure you choose delivers the cash you need without forcing you to factor more than necessary or pay more than expected.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: February 6th, 2026

Business Funding Expert Insights

Comparing Factoring Offers?

Advance rates can quietly increase what you pay, even when the rate looks competitive. Before you sign, a quick review can reveal whether you’re factoring more than you need or paying more than expected.