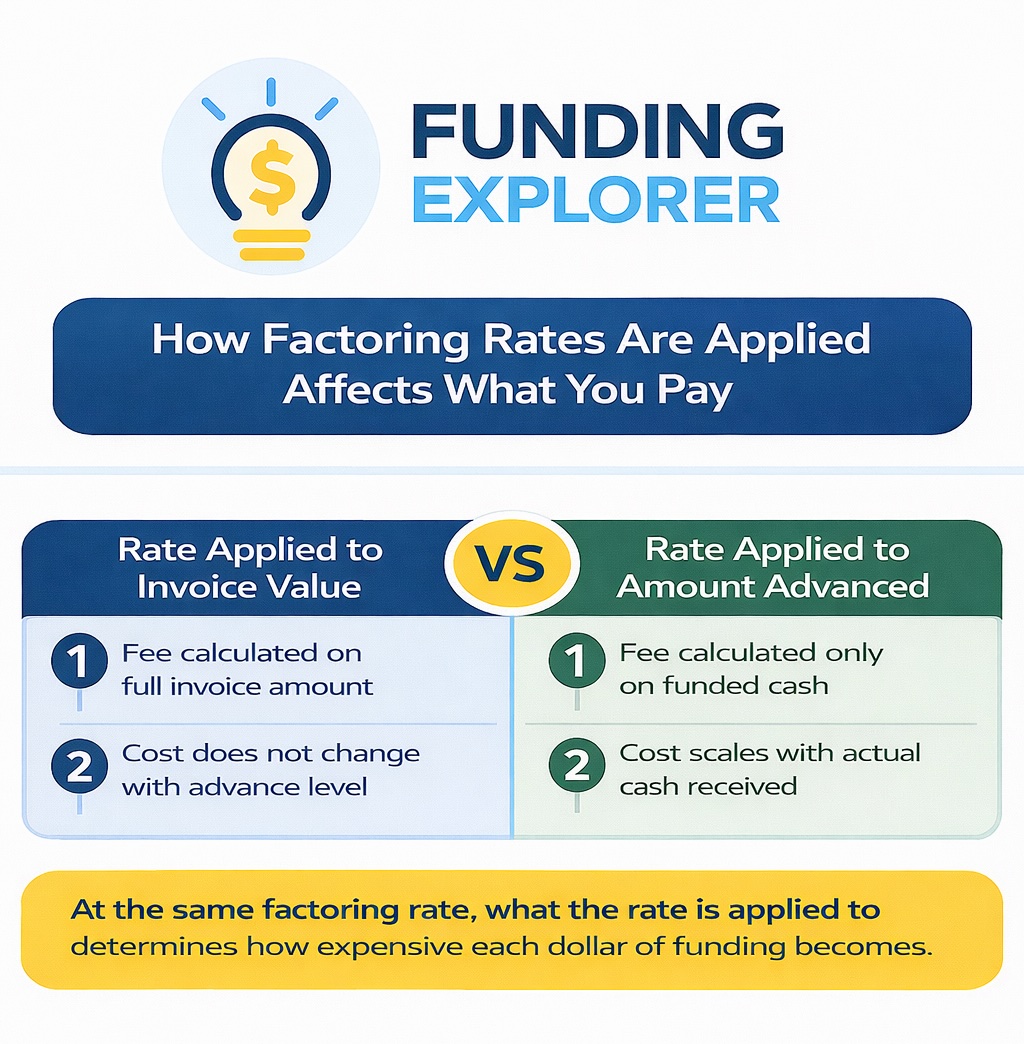

Factoring rates don’t tell the whole story. Whether a rate is charged on the invoice value or on the amount advanced can significantly change what you actually pay. Two similar rates can lead to very different annual costs.

When businesses compare factoring offers, they usually start with one number: the rate.

A quote of 2.25% sounds cheaper than 2.50%, so it’s natural to assume the lower rate means lower cost. But many businesses later discover that their actual costs don’t match that assumption.

One of the biggest reasons is rarely explained upfront: what the factoring fee is actually charged on.

Two factoring agreements can quote similar rates and still produce very different costs depending on whether fees are calculated on the invoice value or on the amount advanced. Before you compare proposals, you need to know the difference.

The Two Common Ways Factoring Fees Are Calculated

Most factoring agreements calculate fees in one of two ways:

Fee charged on the invoice amount

The rate is applied to the full face value of the invoice, regardless of how much cash is advanced.

Fee charged on the advance

The rate is applied only to the funding the business actually receives upfront.

Both structures are common. Neither is inherently better. The difference shows up in how much you actually pay for the funding you receive, especially over time.

At the Same Rate, Fees Charged on Advances Cost Less

Let’s start with the most basic and simple comparison:

These are our assumptions for this example

- Monthly invoices factored: $300,000

- Factoring rate: 2.50%

- Advance rate: 85%

- Factoring is used consistently throughout the year.

Fee Charged on Invoice Value

- Monthly fee: 2.50% × $300,000 = $7,500

- Cash received monthly: 85% × $300,000 = $255,000

Annual cost

- $7,500 × 12 = $90,000

Fee Charged on Advance

- Monthly fee: 2.50% × $255,000 = $6,375

- Cash received monthly: $255,000

Annual cost

- $6,375 × 12 = $76,500

Nothing else changes: same invoices, same rate, same advance, same funding received.

The only difference is the fee base.

Annual difference: $13,500

At the same rate, charging the fee on the advance results in a materially lower annual cost for the same funding.

| Item | Fee on Invoice Value | Fee on Amount Advanced |

|---|---|---|

| Monthly invoices factored | $300,000 | $300,000 |

| Advance rate | 85% | 85% |

| Cash received monthly | $255,000 | $255,000 |

| Factoring rate | 2.50% | 2.50% |

| Monthly factoring fee | $7,500 | $6,375 |

| Annual factoring cost | $90,000 | $76,500 |

When a Lower Rate on Invoice Value Can Be More Expensive

Now let’s look at a scenario that appears frequently in real factoring proposals.

Assumptions

- Monthly invoices factored: $300,000

- Advance rate: 85%

- Factoring used year-round

Scenario A: Lower Rate, Fee Charged on Invoice

- Factoring rate: 2.25% on invoice

- Monthly fee: 2.25% × $300,000 = $6,750

- Cash received monthly: $255,000

Annual cost

- $6,750 × 12 = $81,000

Scenario B: Higher Rate, Fee Charged on Advance

- Factoring rate: 2.50% on advance

- Monthly fee: 2.50% × $255,000 = $6,375

- Cash received monthly: $255,000

Annual cost

- $6,375 × 12 = $76,500

Even though 2.50% is higher than 2.25%, Scenario B costs $4,500 less per year for the exact same funding.

This is where many businesses get misled. A higher quoted rate does not automatically mean higher cost. What matters is what the rate is applied to.

| Item | Lower Rate on Invoice | Higher Rate on Advance |

|---|---|---|

| Monthly invoices factored | $300,000 | $300,000 |

| Advance rate | 85% | 85% |

| Cash received monthly | $255,000 | $255,000 |

| Rate applied to | Invoice value | Amount advanced |

| Factoring rate | 2.25% | 2.50% |

| Monthly factoring fee | $6,750 | $6,375 |

| Annual factoring cost | $81,000 | $76,500 |

Why These Comparisons Can Still Change in Real Life

In real operations, cash needs, funding frequency, and other variable factors can change how these structures perform over time. Depending on the business’s situation, those factors can either reinforce the savings shown above or reverse them.

That’s why there is no universally “cheapest” fee structure.How Funding Explorer Helps Businesses Compare Fee Structures

At Funding Explorer, we help business owners look beyond the factoring rate.

We compare factoring offers by evaluating:

- Whether fees are charged on invoices or advances.

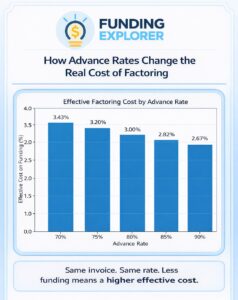

- How advance rates affect funding costs.

- How much invoice volume must be factored to meet cash needs.

- How other additional factoring fees not related to the rate (e.g., wires, processing, etc) affect the effective rate you end up paying.

The goal isn’t to push one structure over another. It’s to make sure the option you choose delivers the cash you need, without increasing costs or forcing unnecessary factoring volume.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: February 9th, 2026

Business Funding Expert Insights

Before you choose a factoring offer, make sure you know what you’re really paying.

At Funding Explorer, we help business owners compare factoring proposals based on how rates are applied, how much cash you’ll actually receive, and what the total annual cost looks like, not just the rate.