Quick Summary (At a Glance)

- Problem: Waste haulers and disposal companies often wait 30–90 days for customer payments.

- Why it matters: Fuel, landfill fees, equipment repairs, insurance, and payroll have to be paid weekly, not monthly.

- Solution: Factoring turns outstanding invoices into same-day cash, typically advancing 85–95% upfront.

- Outcome:

Why Cash Flow Is a Constant Challenge in Waste Removal

Waste removal work rarely slows down. Whether you’re hauling roll-offs, running front-load or rear-load routes, handling construction debris, or managing environmental cleanup jobs, your team shows up every day, even when payments don’t.

Most waste companies serve slow-paying clients such as:

- Municipalities & cities (public works, sanitation, utilities)

- Construction companies & general contractors

- Property managers & commercial buildings

- Manufacturing plants & industrial sites

- Recycling buyers & material recovery facilities (MRFs)

- Environmental cleanup & remediation primes

These customers often pay on Net-30, Net-45, Net-60, or even Net-90, but your expenses hit much faster.

Meanwhile, you’re covering:

- Fuel for trucks running daily routes

- Landfill and transfer station fees

- Repairs on compactors, roll-off boxes & hydraulics

- Insurance (expensive in this industry)

- Driver wages and overtime

- Tires, maintenance, and DOT compliance

- Replacement trucks or rented units during breakdowns

Your trucks can’t sit still because a customer’s AP department is backed up. That’s where factoring helps.

A Real-World Story: How Factoring Helped a Hauling Company Grow

GreenTrail Waste Services, a mid-sized roll-off and waste-hauling company in the Midwest, served builders, commercial properties, and municipal sites.

They had strong sales, but:

- Over $320,000 sat in unpaid invoices

- Two trucks were down for repairs

- Fuel costs kept rising

- Landfill bills were due weekly

“We weren’t short on work, just short on timing.”

Funding Explorer matched them with a factoring partner that understands hauling and multi-ticket billing. Within days, they began receiving 90% advances within 24 hours.

The impact:

- Put two trucks back on the road

- Bought a new roll-off bin set

- Accepted three new GC contracts

- Stopped relying on high-interest credit cards

“Factoring didn’t change our business; it finally let us keep up with it.” – Juan W. – Co-owner

What Is Invoice Factoring for Waste Haulers? (Simple Definition)

Invoice factoring is the sale of outstanding invoices to a factoring company in exchange for immediate cash advances.

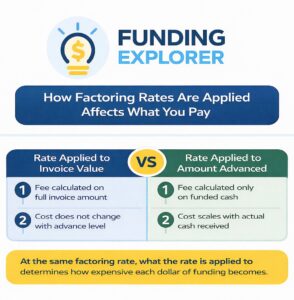

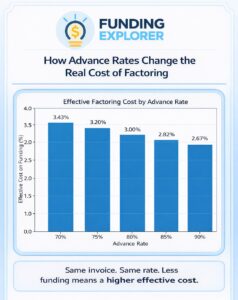

Instead of waiting months for customers to pay, the factor advances most of the invoice upfront, usually 80–95%, and sends you the rest when the customer pays (minus a small fee).

Factoring is not a loan. You will incur no debt, pay no interest, and face no monthly payments. Funding is determined exclusively by your customers’ credit, allowing you to take control of your business without the usual financial burdens.

How Factoring Works for Waste & Disposal Companies

Here’s a simple real-world example:

You complete a $14,000 roll-off hauling job for a commercial contractor. They tell you payment is on Net-60.

Instead of waiting two months:

- You send that invoice to your factoring partner.

- They advance 90%, that’s $12,600, within 24–48 hours.

- You use the cash immediately for fuel, maintenance, or payroll.

- When the contractor pays the invoice, you receive the remaining 10%, minus a typical 3% fee.

Now cash flow matches your workload, not your customers’ timeline.

Who Factoring Is For (and Not For)

Factoring works great for:

- Waste hauling companies

- Roll-off dumpster services

- Construction debris removal

- Scrap & recycling haulers

- Industrial waste & sludge removal

- Environmental cleanup/remediation companies

- Hazardous waste transporters (with approved contracts)

- Junk removal companies with commercial clients

- Medical & bio-waste transportation

Factoring may NOT work if:

- Your customers are residential (individual homeowners)

- Your invoices aren’t itemized or approved

- You only accept payments at pickup (COD model)

If you invoice commercial, municipal, or industrial clients, you likely qualify.

Pros & Cons of Factoring for Waste Removal Companies

Pros

- Fast access to cash (24–48 hours)

- The advances help cover fuel, repairs, landfill fees & payroll

- It’s easy to get approved if your clients pay reliably

- Funding availability scales with your sales (more invoices = more cash)

- The reliable cash flow that is generated helps accept bigger commercial contracts

Cons

- There’s a small fee per invoice

- Customers receive a notice that the invoice has been sold

- Factoring is only available for invoices and debtors that the factoring company has approved.

Key Waste Industry Cash Flow Facts

- Waste and disposal companies often operate on 45–90 day payment cycles.

- Over 40% of commercial contractor invoices are paid late.

Benefits of Factoring for Waste & Disposal Companies

With predictable cash flow, waste companies can:

- Keep all routes staffed & trucks fueled

- Pay landfill fees without stress

- Repair or replace equipment faster

- Manage seasonal spikes in volume

- Take on larger municipal or construction contracts

- Avoid expensive credit cards or high-interest loans

- Stop waiting on slow-paying contractors or cities

It keeps your operation running smoothly, even when customers pay slowly.

What to Consider Before Choosing a Factoring Partner

Not all factoring companies understand waste hauling.

Before choosing a funder, check:

- Do they accept tickets, route logs, or multi-haul invoices?

- Do they fund landfill fees or fuel surcharges?

- Do they understand municipal billing cycles?

- Do they offer same-day funding?

- Do they require personal guarantees?

- Do they handle volume spikes (storm cleanup, construction season)?

Funding Explorer screens all this for you, so you never waste time with the wrong funder.

Why Waste Removal Companies Choose Funding Explorer

Funding Explorer matches you ONLY with factoring companies that already work with:

- Waste haulers

- Roll-off services

- Recycling & scrap haulers

- Environmental cleanup contractors

- Municipal contract haulers

You won’t waste time talking to lenders who don’t fund your industry.

We know exactly which funders support:

- Landfill-fee billing

- Fuel surcharge invoices

- Multi-haul daily tickets

- City and municipal billing

- Construction-related debris hauling

And we match you directly, at no cost or extra fees.

FAQ - Waste & Disposal Factoring

Can small hauling companies qualify?

Yes, approval is based on your customers’ credit history, not yours.

Can factoring cover landfill or tipping fees?

Yes, as long as the fees are included in the invoice.

Does factoring work with daily haul tickets?

Many factors accept ticket-based billing if approved by the customer.

How fast can we get funded?

Usually 2–5 days for setup, then 24–48 hours for advances.

Do I have to factor every customer?

No, you choose who and when.

Keep Your Trucks Rolling With Steady Cash Flow

Your customers rely on you to keep waste moving.

Your business relies on steady cash to keep your trucks on the road.

With the right factoring partner, you can cover fuel, repairs, payroll, landfill fees, and take on bigger accounts without waiting on slow-paying clients.

Let Funding Explorer match you with the best waste-hauler factoring program today.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: December 5th, 2025

Business Funding Expert Insights

Skip the Guesswork: Get the Right Funding Partner

Most factoring companies don’t understand waste operations. We know who does. Get expert, no-cost guidance and a partner who funds hauling, disposal, and environmental cleanup invoices in 24–48 hours.