Your crews brave the heights to keep cell sites and communication networks running, building, upgrading, and maintaining the towers that keep everyone connected. You deliver on every job, but when payments drag for months, it can be tough to keep your own business grounded.

The reality is that most tower contractors wait 30, 60, or even 90 days to get paid by large telecom, utility, and construction clients. Meanwhile, payroll, insurance, equipment leases, and fuel costs come due every week.

That’s where invoice factoring helps tower service companies turn completed work into immediate cash, without taking on debt.

A Real-World Example: Keeping Crews on the Tower

Summit Tower Services, a mid-sized telecom contractor, handles tower builds, antenna upgrades, and maintenance work for several major carriers across the Midwest.

Like many tower companies, they often waited 60–90 days to get paid, even after finishing large projects on time. Payroll, equipment rentals, and travel costs kept piling up, and those long payment cycles made it hard to stay fully staffed between jobs.

With the help of a Funding Explorer partner, Summit Tower began receiving up to 90% of each invoice within 48 hours. The faster funding helped them cover payroll, pay vendors, and keep their cranes and crews running without interruption.

“Factoring gave us the breathing room we needed. Instead of worrying about when payments would clear, we can focus on scheduling the next job.” – Operations Director, Summit Tower Services

What Is Invoice Factoring for Telecommunications Tower Contractors?

Invoice factoring is a fast and flexible financing solution that allows tower service businesses to convert unpaid invoices into working capital.

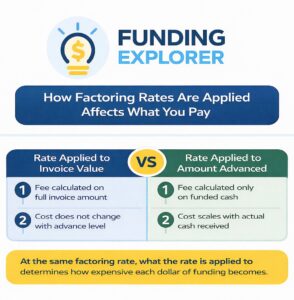

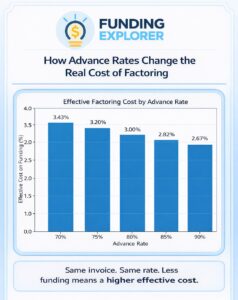

Instead of waiting for slow corporate or carrier payments, you sell your invoices to a factoring company that advances most of the balance, usually up to 95% within 24–48 hours.

When your client pays, you receive the remainder, minus a small service fee (typically 1–4%).

For tower contractors, this means you can keep your crews working and equipment ready, without waiting for delayed accounts payable cycles from large corporations.

Who It's Tower Contractor Factoring For

This funding option is built for companies involved in:

- Tower erection and rigging

- Telecom installation and upgrades (5G, microwave, fiber integration)

- Maintenance and inspection of broadcast and cellular towers

- Structural reinforcement, welding, and painting

- Utility pole and line maintenance

- Emergency storm repair and disaster recovery work

Common business types that benefit include independent tower erectors, turnkey service firms, maintenance subcontractors, and engineering groups supporting major telecom infrastructure.

The Cash Flow Problem Many Tower Companies Face

Every tower company owner knows this challenge: you have to spend a lot before you ever get paid. The work can’t start without covering the basics, like:

- Payroll for your climbers, riggers, and ground crews

- Equipment rentals – cranes, lifts, trucks, and other gear

- Fuel and travel for crews moving between job sites in different states

- Materials, safety gear, and insurance that need to be paid up front

- Delays from weather, inspections, or last-minute project changes

All of that adds up quickly, especially when your invoices take months to get processed.

And since your typical clients are large organizations like:

- Major telecom carriers (AT&T, Verizon, T-Mobile)

- Tower owners and operators (Crown Castle, SBA Communications, American Tower)

- Utility companies and public agencies

- Prime contractors running multi-site rollouts

… it’s no surprise that payments move slowly through corporate systems.

While these clients are creditworthy, they often pay slowly, which can leave smaller contractors facing cash flow gaps between project completion and actual payment.

Factoring provides the cash flow you need right away, allowing you to continue expanding, participating in bids, and managing teams without any interruptions.

Key Facts About Tower Contractor Cash Flow

Most tower subcontractors report average payment terms of 45 to 90 days, according to the National Association of Tower Erectors (NATE).

The Factoring Process: Turning Completed Work Into Immediate Cash

Here’s how factoring works for tower companies:

- You complete a job, such as a $120,000 tower erection project or a $35,000 antenna upgrade, and send the invoice to your client.

- You also submit that invoice to your factoring partner.

- Within 24–48 hours, you receive up to 95% of that invoice’s value directly into your business account.

- Once your client pays, you get the remainder, minus a small factoring fee.

It’s simple, fast, and requires no collateral, loans, or credit checks on your business; approval is based on the strength of your clients.

How Funding Explorer Helps Tower Contractors

Funding Explorer connects tower service companies with factoring programs designed specifically for telecom and infrastructure contractors.

Why it works:

- You get fast funding on approved invoices, often in 24–48 hours.

- The credit decisions are based on your financial background, not your FICO score

- The service is designed to support progress billing and milestone payments.

- There are no setup fees or long-term commitments.

- We have partners that offer programs tailored for tower erection, maintenance, and installation work.

It’s a free advisory and matching service, built to help tower businesses access reliable cash flow, especially during project surges or carrier delays.

Questions About Factoring Tower Companies Ask Most

Can small or regional tower contractors qualify for this program?

Yes. Whether you manage two crews or twenty, you can qualify if your clients are reputable carriers, tower owners, or utilities. Approval depends on your clients’ payment history, not your credit score.

What types of invoices can be factored?

Any completed work for telecom carriers, tower owners, or general contractors, including installation, upgrade, or maintenance projects with signed approvals or completion certificates.

How fast can funding be available?

Once approved, you can receive your first advance in 2–3 business days. After that, most contractors get same-day funding for verified invoices.

Does factoring work with progress or milestone billing?

Yes. Many tower contractors use factoring for partial payments or rolling progress invoices as large projects advance.

Can I choose which invoices to factor?

Absolutely. You stay in control by factoring only what you need to manage operations, or all invoices if you want a steady cash flow.

Stay Grounded with Reliable Funding

In tower construction and maintenance, your clients depend on you to keep networks live, but your business depends on getting paid.

With the right factoring partner, you can cover payroll, equipment, and fuel costs without waiting for carrier payments to arrive. Contact our experts today to quickly get the funding you need to grow your business.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: November 14th, 2025

Business Funding Expert Insights

Get Expert Guidance at No Cost

Cut through the noise and skip the confusion. Our experts, with over 20 years of experience in business funding, will match you with the factoring program that truly fits.