Surveyors do their work long before most people ever step onto the project. You’re out there marking boundaries, collecting GPS data, flying drones, scanning coastlines, or staking construction layouts so the rest of the project can even begin. But while the fieldwork moves quickly, the financial side rarely does.

Payments from general contractors, engineering firms, developers, and public agencies often take weeks or months to make their way through internal review and approval, even though your crews, equipment, travel, and software costs come due immediately.

Invoice factoring gives surveying companies a steady cash flow so they can stay productive, add new clients, and keep crews in the field without waiting on slow-paying customers.

A Success Story & Testimonial

Precision Land Surveying, a small surveying firm in Georgia, that handles boundary, topo, and construction staking for developers and engineering firms.

Strong sales, but slow payments, left them waiting on over $180,000 in receivables.

“We weren’t struggling with sales; we were struggling with timing.”

Funding Explorer matched them with a factoring partner experienced in construction and engineering billing.

Within days, Precision began receiving 90% advances within 24 hours.

The results:

- Added a second full-time field crew

- Purchased a new GPS rover and drone

- Expanded into two more counties

- Took on larger commercial projects

“Factoring didn’t change our work. It changed how fast we could say yes to new jobs.” – Andy J. – Manager

What Is Invoice Factoring for Surveyors?

Invoice factoring is a cash flow solution that allows surveying firms to turn outstanding invoices for completed survey work into immediate working capital.

Instead of waiting weeks or months for a GC, engineering firm, or municipality to pay, you send that invoice to a factoring company.

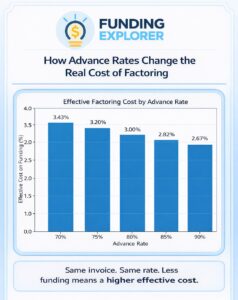

They advance most of the amount, usually 80–95% within 24–48 hours, and you receive the rest once the client pays (minus a small fee).

For surveyors, factoring isn’t a loan. There’s no debt, no interest, and no long-term commitments. It’s simply getting the money you’ve already earned, faster.

Why Surveying Companies Use Factoring

Surveying companies incur various operational costs to deliver their services, such as:

- Payroll for field crews, technicians, and office staff

- GPS/GNSS receivers, total stations, drones & scanners

- Equipment leases, repairs & calibration

- Software tools: Civil3D, Trimble, Leica, GIS platforms

- Truck and vehicle expenses

- Travel to multiple job sites

- Insurance, licensing & certifications

Meanwhile, your clients, like general contractors, engineering firms, developers, ports, marine contractors, and municipalities, often take 30–90 days (or more) to pay due to multi-step approval processes.

Factoring helps bridge this cash flow gap, allowing daily operations to continue smoothly.

How Factoring Works for Surveying Companies

Here’s a quick example of how it works:

You finish an $18,000 construction surveying job and send the invoice to your client. Instead of waiting weeks to get paid, you forward that invoice to your factoring partner. Within 24–48 hours, they advance 90% (that’s $16,200) so you can pay your crew, fuel trucks, or prep for the next project. When your client eventually pays, you get the remaining 10% minus, let’s say, a pre-agreed 3% fee.

- Typical payment cycles run 45–90 days, especially on construction and engineering projects.

- Over 40% of invoices from general contractors and engineering firms are paid late nationwide.

Surveying Companies That Benefit Most From Factoring

Factoring supports any surveying business that relies on Net payment terms, including:

- Land Surveyors: Boundary, topo, subdivision, plat surveys

- Construction Surveyors: Construction staking, layout, grade checks, as-builts

- Engineering & Civil Survey Support: Utility, pipeline, DOT, highway, and municipal projects

- GIS & Mapping Companies: Drone surveys, aerial imagery, GNSS data, utility locates

- Environmental & Specialized Survey Firms: Wetlands, floodplain, environmental mapping, and geotechnical support

- Water, Marine & Hydrographic Surveyors: Coastline & shoreline mapping, Bathymetric/hydrographic surveys, Harbor, port & channel surveys, Dock, seawall & marine construction support, Offshore & nearshore survey operations

Marine surveyors often face longer payment cycles due to multi-agency reviews, regulatory approvals, and environmental documentation, making factoring especially useful.

Benefits of Factoring for Surveyors

Surveying work comes with a lot of moving parts, and cash flow can get tight quickly. Many firms run into challenges like:

- Long project timelines that drag out billing

- Multi-phase work where payments don’t come until the next stage

- Engineering reviews that slow everything down

- Equipment repairs, calibrations, and unexpected downtime

- Permits or agency approvals that take forever

- Clients asking for revisions or updated deliverables before they release payment

With steady cash coming in, surveying companies can keep projects moving and crews supported. Factoring makes it easier to:

- Keep multiple field teams working without worrying about payroll

- Upgrade and maintain GPS, drone, and scanning equipment when needed

- Pay staff on time—even when clients are slow to pay

- Expand into new service areas or take on bigger projects

- Bid confidently on commercial or municipal contracts

- Avoid maxing out credit cards or juggling expensive lines of credit

Why Surveyors Choose Funding Explorer

Not all factoring companies understand surveying. Many won’t fund multi-phase, engineering-linked, or construction-related invoices. Funding Explorer eliminates the guesswork.

We already know which factoring partners best serve:

- Surveying companies

- Construction staking specialists

- GIS & drone mapping services

- Marine & hydrographic surveyors

- Engineering support firms

You don’t waste time applying with lenders who can’t fund your type of work.

Common Questions Surveyors Ask About Factoring

Can small surveying companies qualify?

Yes. Approval depends on your clients’ payment history, not your own credit.

Does factoring work for multi-phase or milestone-driven projects?

Yes. Many survey firms use progress billing, and factoring supports these structures.

Can I factor invoices from engineering firms or general contractors?

Yes. These are among the most common surveyor invoices to factor.

Can marine or hydrographic surveyors use factoring?

Yes. These surveyors’ complex contracts and long approval cycles often make them excellent candidates for factoring.

How fast can I get funded?

Usually, within 2–5 days for initial setup; same-day funding is common afterward.

Do I have to factor every job?

No. You choose which customers and invoices to factor.

Strengthen Your Surveying Operations With Steady Cash Flow

Factoring helps you keep field crews funded, equipment upgraded, and projects moving, no matter how slow payments come in.

Keep your crews moving and your projects on schedule.

Let Funding Explorer connect you with the ideal surveying factoring partner.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: December 2nd, 2025

Business Funding Expert Insights

Get Expert Guidance at No Cost

Whether you handle land surveys, construction staking, ALTA projects, or marine/hydrographic work, you need a partner who understands your billing cycles. We connect you with factoring companies with knowledge of the surveying industry.