Have you ever had to cancel or delay a ride because there was no money left for gas? Many transportation companies face this problem. Non-emergency medical transportation, also called NEMT, helps people reach important care. But the money you earn often comes in much more slowly than the costs you pay every day.

This is not about bad planning. It is about working in an industry where payments crawl, but your schedule never stops. That is why the right funding partner matters. Finding one can change everything.

A Real Example & Testimonial

Angela owns MediMove in Florida. When a big hospital gave her more routes, her costs doubled overnight. Payroll and fuel went up fast, but payments from her clients were still weeks away.

“I did not need a sales pitch. I needed someone who understood how billing works in this business.”

In less than a week, she was matched with a factoring company that advanced 85 percent of her invoices in under two days. She covered payroll, filled her gas tanks, and even bought two new vans with wheelchair lifts.

“They found me a partner who actually understood my business. Now my cash flow matches the work we do every day.”

Why Cash Flow is Always Hard in NEMT

No matter if you run two vans or a whole fleet across cities, you probably face the same problems:

- Delayed payments. Hospitals, nursing facilities, and other heathcare institutions may take 30, 45, or even 60 days to pay.

- High daily costs. You need to cover fuel, payroll, and repairs right away. Growth is moving faster than cash. Adding more routes for dialysis centers or senior homes means more costs before the first check clears.

- Billing mistakes. Even one denied invoice can hold up thousands of dollars.

Your vehicles stay busy, but your account balance stays stuck.

How NEMT Invoice Factoring Works

Factoring helps smooth the road ahead. Here is how it works for NEMT:

- Submit invoices. Share bills for trips completed for hospitals, nursing homes, dialysis centers, or private contracts.

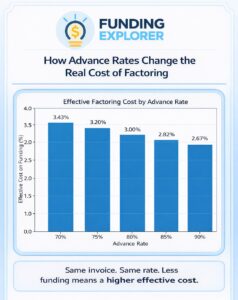

- Get cash flow fast. You can receive 70 to 90 percent of the invoice amount within 24 to 48 hours.

- Your clients pay as usual. Hospitals, facilities, or brokers keep paying on their regular timeline.

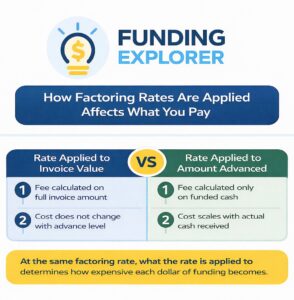

- You receive the rest. Once payment clears, you get the balance minus an agreed-upon fee usually between 1 to 5% every 30 days, depending on volume and customer credithworthiness.

Every medical transportation company is different. That is why the best funding partner should fit your contracts, your growth, and your pace.

Did Your Know?

The U.S. NEMT market was valued at about US$ 6.5 billion in 2023, and is forecast to reach US$ 13.44 billion by 2031.

Why Our Expert Guidance Works

- Each suggestion is based on your specific needs, and growth plans.

- Our service is free to you.

- We know the reality of medical transportation daily expenses and slow payments, and we connect you to partners who understand that too.

Common Questions About Medical Transportation Factoring

Q: How do I know which partner is right?

We review your special needs and then recommend the best fit.

Q: Can small companies use factoring?

Yes. If you have steady invoices, factoring can help, no matter your size.

Q: Can funding grow with my business?

Yes. As you add more invoices, your advances grow too.

Why Medical TraNsportation Providers Trust us

We understand the struggles of keeping routes running while waiting for payments. That is why we focus on finding partners who know the NEMT industry. With the right support, your operations never have to stop for cash.

Let’s Keep Your Fleet Moving

Your situation is unique. Let’s talk about your your cash flow needs. We will match you with a trusted funding partner so you can keep your patients on time and your business strong.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: October 1st, 2025

Business Funding Expert Insights

Get Expert Guidance at No Cost

Cut through the noise and skip the confusion. Our experts, with over 20 years of experience in business funding, will match you with the factoring program that truly fits.