Have you ever completed a major IT project and then waited weeks or even months for payment while your team’s payroll, software licenses, and infrastructure bills demand attention? Many IT service companies face that timing mismatch every month. You keep clients’ systems running, but your cash flow lags.

This is not about poor planning. It’s about working in an industry where client payments come slowly, while expenses are immediate. That’s why choosing the right funding partner is so important. When matched well, invoice factoring can be a game-changer.

A Real Example & Testimonial

Oscar owns CyberCore Solutions, an IT firm specializing in cloud migrations. When he signed two big enterprise contracts, his workforce and infrastructure costs exploded overnight. He needed funds to pay contractors, upgrade servers, and buy licenses, but his clients were still on extended billing cycles.

“I didn’t want a generic pitch. I needed someone who actually understands how slow corporate payments can be in tech.”

Within two days, we matched him with a factoring partner that specializes in IT contracts. They advanced 85% of his invoices in under 24 hours. Oscar covered payroll, kept the work going, and didn’t lose momentum.

“They found me a partner familiar with IT services, not just a lender. Now my cash flow finally matches our output.”

The Cash Flow Struggles Every IT Firm Knows

Whether you run a small managed service provider, a software-consulting agency, or an IT outsourcing firm, these common challenges will feel familiar:

- Delayed payments. Large firms, corporate clients, or vendors often pay 30, 60, or 90 days after invoicing.

- High recurring costs. Your team, cloud services, software tools, licensing, and security overhead don’t pause.

- Growth consumes cash. More business and larger contracts create extra costs before any revenue is generated.

- Billing disputes & scope creep. Even small disagreements or change orders can delay tens of thousands in payment.

You are involved in numerous projects, yet your financial statements continue to be under pressure. It’s crucial to take action to improve this situation!

How Factoring Turns IT Invoices into Cash

Factoring gives you access to working capital without waiting for clients to pay. Here’s how it works, adapted for IT services:

- Submit your invoices. You provide invoices for completed work, including consulting, managed services, software projects, and support contracts.

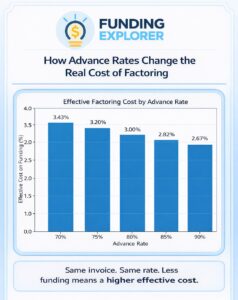

- Receive a cash advance. You get 70%–90% of the invoice amount in your account, typically within 24–48 hours.

- Clients pay as usual. Your clients continue to pay according to their agreed-upon terms.

- Get the balance. Once the client settles the invoice, you receive the rest minus an agreed fee (e.g., 1–5% per 30 days, depending on volume and risk).

Every IT business is unique, so a good factoring partner will tailor their services to match your contracts, billing cycles, and client profile.

Quick Facts on IT Services and Cash Flow

- The U.S. IT services market was valued at USD 405.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of approximately 7.9% through 2030.

- Many service firms utilize invoice factoring to manage cash flow during tight billing cycles.

How We Match IT Firms with the Right Funding Partner

We’ve helped many technology and IT service providers find funding partners who truly understand their challenges:

- Every recommendation is based on your contract terms, client payment behavior, and growth plans.

- Our matching service is free to you.

- We know how fast expenses move and how slow large clients pay. We connect you with partners who understand.

When your cash flow aligns with your operations, growth stops being risky and starts being logical.

Questions IT Firms Ask About Factoring

Q: How do I know which factoring partner is the right fit?

A: We review your client portfolio, billing terms, and monthly volume, then recommend the partner that fits best.

Q: Can small agencies use factoring, too?

A: Yes. Even if you’re a smaller IT company, if you have steady invoices, you can benefit.

Q: Can funding grow with my business?

A: Yes. The more creditworthy customers you have and receivables your business produces, the bigger the credit line that’ll be available to you.

Why Tech Companies Rely on Our Expertise

We understand the strain of completing projects while waiting for payments. We don’t just link you to any funder; we find one who understands IT. With the right partner, your operations never stall for cash.

Keep Your IT Projects on Track with Factoring

Your projects, contracts, and cash flow needs are unique. We’ll match you with a trusted factoring partner at no cost, so you can focus on building software, systems, and solutions, not chasing payments.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: September 29th, 2025

Business Funding Expert Insights