A spotless office. A shining school hallway. A disinfected hospital wing.

Your cleaning team keeps businesses safe, healthy, and professional, yet when it comes to getting paid, the wait can feel endless.

Commercial cleaning companies often bear the burden of weekly payroll, supply orders, and equipment maintenance, all while waiting 30, 60, or even 90 days for clients to pay.

You’ve already done the job; now you need the cash to keep going.

Factoring for commercial cleaning companies gives you access to the money locked in unpaid invoices, so you can cover your expenses, take new contracts, and stay ready for whatever the next work order brings.

A True Story from the Field

Melissa owns ClearBright Facility Services, a regional cleaning company with 40 employees.

She recently landed two contracts, a medical center and a local school district, but both had net-60 payment terms.

“It was the best month of sales we’d ever had, and the hardest to afford”

We matched her with a factoring company that already understood cleaning contracts. Within 24 hours, she received an 85% advance on her invoices.

“I didn’t have to slow down hiring or turn down new jobs. The factoring company got what I do, that was the difference.”

Three months later, ClearBright expanded into two new cities and upgraded its equipment fleet without taking on a single loan.

When the Jobs Don’t Stop, But the Payments Do

Cash flow is the biggest challenge in this business, and not because of poor planning. It’s because your costs come daily, while your income comes eventually.

Typical cleaning companies deal with:

- Corporate clients who pay slowly. Property managers, hospitals, and facility service contractors, such as ABM Industries, JLL, or C&W Services, often take 45–60 days to process invoices.

- Front-loaded expenses. Chemicals, trash liners, microfiber gear, PPE, and floor care machines come out of your pocket before a job even begins.

- Payroll that can’t wait. Cleaners, supervisors, and nighttime crews rely on consistent paychecks, even when clients delay.

- High competition and thin margins. Winning contracts often means offering credit terms, which stretches your cash even thinner.

- Surges in demand. Deep cleaning contracts after construction or during flu season can multiply your costs overnight.

Even the best-run cleaning companies can end up short on cash when payments lag.

How Factoring Works: Picture It Like This

Think of factoring as your financial rinse cycle; it clears out the waiting period between cleaning and payment.

Here’s how it plays out in real life:

You perform the cleaning. Your team finishes the job, maybe it’s a corporate office, a medical building, or a shopping mall. You send the invoice to the customer and submit it to the factoring company.

You get paid (almost) instantly.

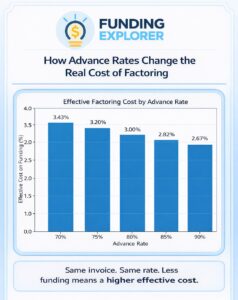

Instead of waiting months, a factoring company gives you most of that money upfront, usually 70–90% of the total, often within 24 hours.

They wait, not you.

Your client (such as a property manager or facility services group) pays their invoice on their normal timeline, just as always.

You get the rest.

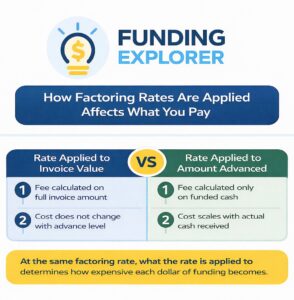

When the payment arrives, you will receive the remaining balance, minus a small service fee, typically 1-5% per 30-day period.

The Numbers Behind the Industry

- The U.S. market for commercial cleaning services approached $100 billion in 2024, mainly due to the implementation of stricter health and safety regulations in workplaces, educational institutions, and healthcare facilities. This industry is projected to maintain steady growth through 2030.

- Despite the growth, slow payments remain a pain point, making factoring one of the most practical cash flow tools for cleaning contractors and facility service providers nationwide.

The Funding Partner Cleaning Companies Count On

We know how tough it can be to run a service business with delayed payments.

That’s why we help cleaning companies find funding partners who already understand your industry.

With Funding Explorer, you get:

- Free, expert guidance from specialists with over 20 years of experience.

- Personalized matches with factoring partners that fund cleaning services fast.

- Access to companies familiar with your clients and billing cycles.

- A simple, fast process built around your cash flow goals.

You work hard to make every client’s space spotless, and we make sure your cash flow stays clean, too.

Common Questions About Commercial Cleaning Factoring

Q: What types of cleaning companies use factoring?

Janitorial contractors, floor care specialists, construction cleanup teams, and facility maintenance providers, basically anyone with steady B2B contracts.

Q: Do I need a long business history to qualify?

No. Even newer companies can qualify if their clients are established and have a proven creditworthiness.

Q: Can I use factoring only when I need it?

Yes. You can factor just a few invoices or all of them, whatever keeps your operations steady.

Q: How soon do I get funds?

Once the account is set up, most cleaning businesses receive payment within 24 hours of invoice approval.

Power Your Cleaning Company’s Next Step with Fast Funding

You’ve built a business that runs every night, weekend, and early morning, but your cash shouldn’t have to wait.

With the right factoring partner, you can stay ahead on payroll, grab new contracts, and grow your business with confidence.

Analia Miguel is an MBA and former CPA with 20+ years in business finance and marketing, including 14 years in alternative business finance. She helps business owners understand their funding options and choose cash flow solutions that truly fit their needs.

Last Updated: October 22nd, 2025

Business Funding Expert Insights

Get Expert Guidance at No Cost

Let Funding Explorer match you with a trusted factoring provider, free of charge, so you can focus on cleaning, not collecting.